Boston: The Federal Investigator arrested three individuals on Thursday on charges of conspiring to deceive banks into the alleged process of processing more than $ 150 million credit card payments and discharge on behalf of traders involved in businesses that are prohibited and at high risk, including online gaming, debt, debt Relief, Online Pharmacy and payday loans.

The fourth individual remains in general.

Two of Individuals – Ahmad “Andy” Khawaja, 49, from Los Angeles and Thomas Wells, 74, from Martin County, Florida was charged with a conspiracy of wire fraud.

The other two – Mohammad “Moe” Diab, 45, from Glendale, California, and Amy Ringler Rountree, 38, Logan, Utah were charged with wire fraud conspiracies and bank fraud conspiracies.

Diab, Rountree and Wells were arrested Thursday and will appear in the Federal Court in Boston later on, said investigators.

Khawaja was charged in the indictment of December 2019 with financial violations of the campaign and obstruction of justice.

He remains a fugitive.

Investigation of 2018 by the Associated Press shows that Khawaja companies help pornography, shaded debt collectors and offshore gamblers access international banking systems, often by using foreign companies Dummy and fake sites to disguise the underlying business.

Reporting is based on thousands of internal company records obtained by AP.

Khawaja is the owner and Chief Executive Officer of Allied Wallet, Inc., a payment processing company headquartered in Los Angeles which serves traders who do business through the internet.

Diab served as Chief Operating Officer and Rountree was the vice president of the operation, according to the US lawyer office in Massachusetts.

The Allied Wallet gained access to services that enable them to receive debit and credit card payments through a global electronic payment network run by Visa, MasterCard, American Express, Discover, and other cards.

The company serves as an intermediary between trader and financial institutions clients.

Wells, through its company, priority payment, introduces a trader client who is looking for processing payments to the Allied Wallet.

The investigator accuses four involved in the scheme to deceive card brands and others with cheat induces them to provide payment processing services to traders involved in transactions that are prohibited or at high risk, and to traders who are stopped for fraud, reject other payments or compliance Concerns, by consciously misinterpreting the types of transactions of traders are processing and the true identity of the traders.

The defendants allegedly created shell companies, designed fake sites intended to sell retail goods and low-risk homes and used industrial standard code which was wrong in the actual seriRatorium of the transaction, the researchers said, in the end it cheatedly gained more than $ 150 million in payment card processing.

Through more than 100 fake traders.

The note obtained by the AP shows that the company did it while Khawaja, allied wallets and top executives contributed at least $ 6 million to Democratic candidates and the Republicans.

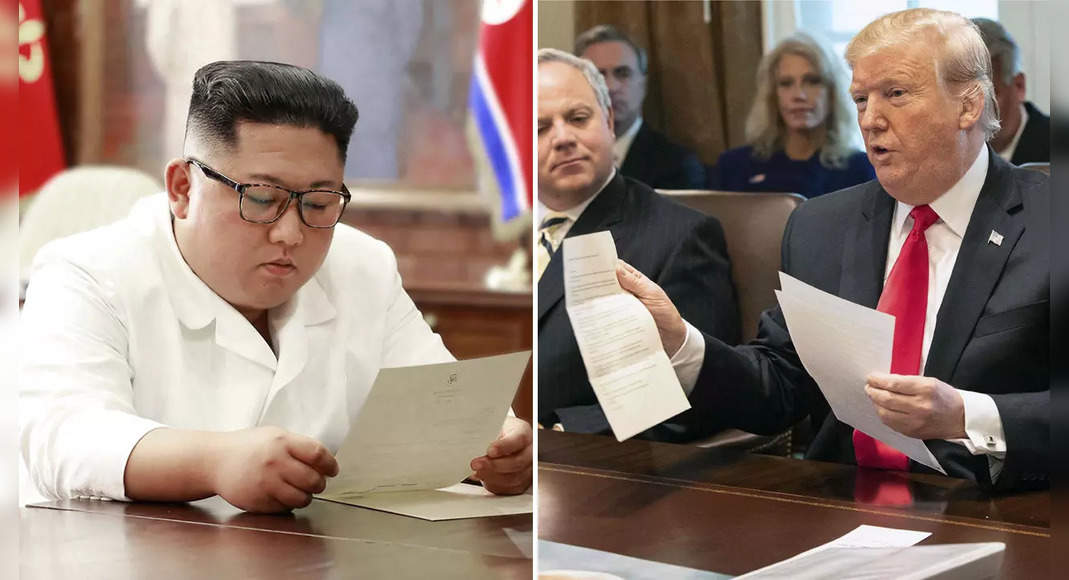

The contribution produced Khawaja access to Hillary Clinton during the presidential campaign and visiting post-election oval office with Donald Trump.

The cost of conspiracy of wire fraud brings a sentence of up to 20 years in prison and a fine of $ 250,000.

Bank fraud conspiracy costs provide a sentence of up to 30 years in prison and a fine of $ 1 million.

Khawaja did not return the message sent to his email address at Allied Wallet.

Calls to the Allied Wallet are not answered.