By Ateeq Shaikhhhome inventory in MMR has been reduced by half; Can fall further with unsold stock housing in the Mumbai Metropolitan region (MMR) drastically dramatically due to a pandemic-induced lock that is valid until now.

Momentum is likely to continue more sales than the new project launched.

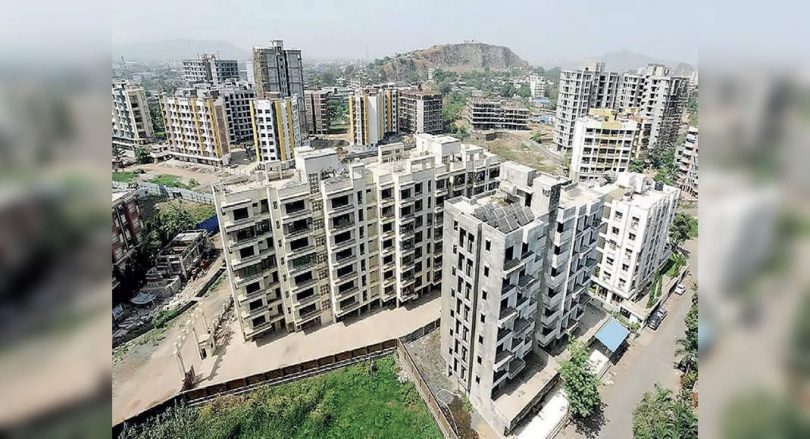

Overall, almost half of the inventory of overhang is on the outskirts of MMR and the outskirts of the expanded outside of Defender, Panvel, Kalyan, Bhiwandi, Titwala, Ambernath, Badlapur, etc., where the sponge of affordable housing stock is located.

Of the total unsold shares 2.81,601 units, 1,27,660 units are in this area.

Second, although there is a residential sales record since August 2020, between Q4 2020-21 (Oct-Dec’20) and Q1 2021-22 (Jan-Mar’21) there has been a surge in inventory by 17 percent or 8 months.

At the end of Q1 2020-21, overhang inventory is 136 months or 11 years and 4 months.

Less than a year later, namely at Q4 2020-21, this down substantially only 48 months or 4 years.

With the project it was launched again in the real estate market, once again, there was an increase at the level of housing stocks that were not sold to 56 months or 4 years and 8 months.

Although there is an increase in the month inventory of 10 months, there are still 59 percent of the years in the same term, according to data compiled by Liases FORAS, an independent non-broking real estate research company.

“Increased month inventory of 10 months is caused by a reduction in the average sales figures and the third waves that will destroy high sales lines,” said Pankaj Kapoor, Managing Director, Lias Futter.

In the past year, most of the sales have occurred in the new Mumbai market followed by the suburbs of the center, the city of the island and the western edge.

However, there has been an increase in marginal inventory within the Mumbai limit which is the suburb of the middle and western cities and the city of the island.

“This is because of the launch of one or two projects,” Kapoor explained.

The project launch pipeline has been subdued and the possibility of remaining so for three to four other quarters, Kapoor said, there will be more sales than launched.

Therefore, the overall inventory rate in MMR is likely to fall further.

For more than a year now, some industrial players and research reports have indicated that there has been a high demand to be ready to move at home compared to less construction.

Therefore, Realtors focus more on cleaning their inventory which is not sold by completing the project rather than launching one.

According to Anarock research, a real estate research company, sales trends go beyond the launch of the possibility of continuing up to 2023.

“In 2023, the supply would grow by 11 percent and sales of 22 percent over 2019,” said Anuj Puri, Chairperson, Property Consultant Anarock.