Mumbai: Bank India’s reserve scheme, one OMA Ombudsman ‘is part of its strategy to overcome customer complaints, which has doubled after a surge in banking transactions due to increased digital adoption.

According to RBI data, with increased awareness, digital penetration and financial inclusion, the number of complaints on various entities regulated more than twice the 1.6 lakh at FY18 to 3.3 lakh fy20.

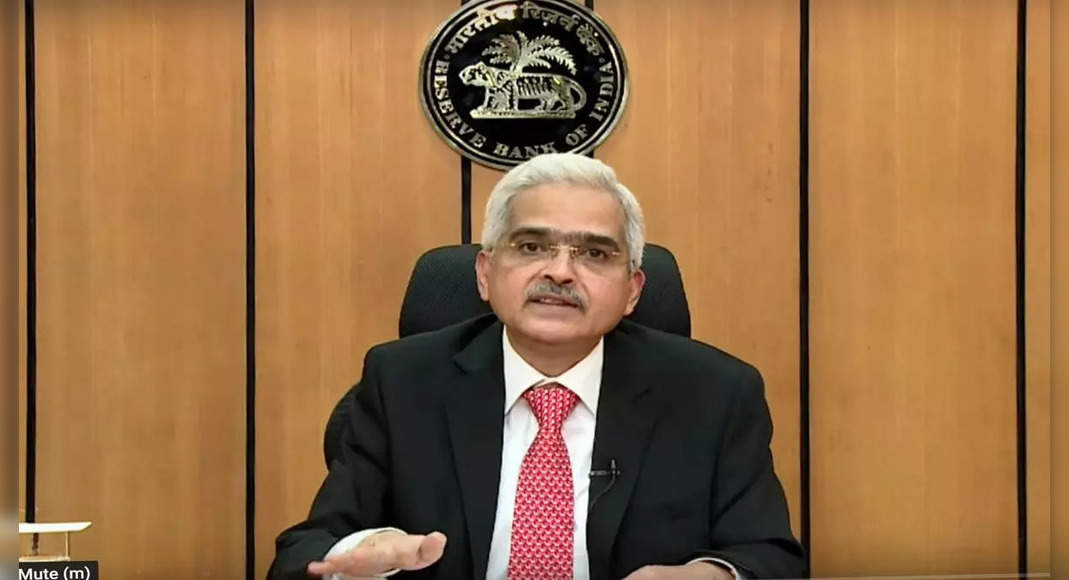

The Integrated Ombudsman scheme will be launched by the Prime Minister on Friday along with a scheme for retail participation in the main auction of government securities.

Under the G-SECS retail scheme, individual investors can access online portals to open securities accounts with RBI, bid in the main auction and buy & sell securities on the market.

There are no fees to be charged for services provided under the scheme.

The integrated scheme allows customers to file their complaints from anywhere every time through the portal / email, or through physical mode at one point of receipt, without the need to identify Ombudsman or certain schemes.

This will eliminate the limitations of jurisdiction and limited reasons for complaints.

The RBI will provide a reference point for customers to send documents, track the complaint status submitted and provide feedback.

Complaints not covered in the ombudsman scheme will continue to be attended by the RBI regional office.

The Integrated Ombudsman scheme is based on the Internal Bank complaints review and other regulated entities.