Mumbai: On Christmas Eve in 2013, the Bank of India’s reserve (RBI) has issued records that warn Indians about the risk of financial, legal and security of Cryptocurrency.

It came four years after the first Cryptocurrency in the world, Bitcoin, was launched.

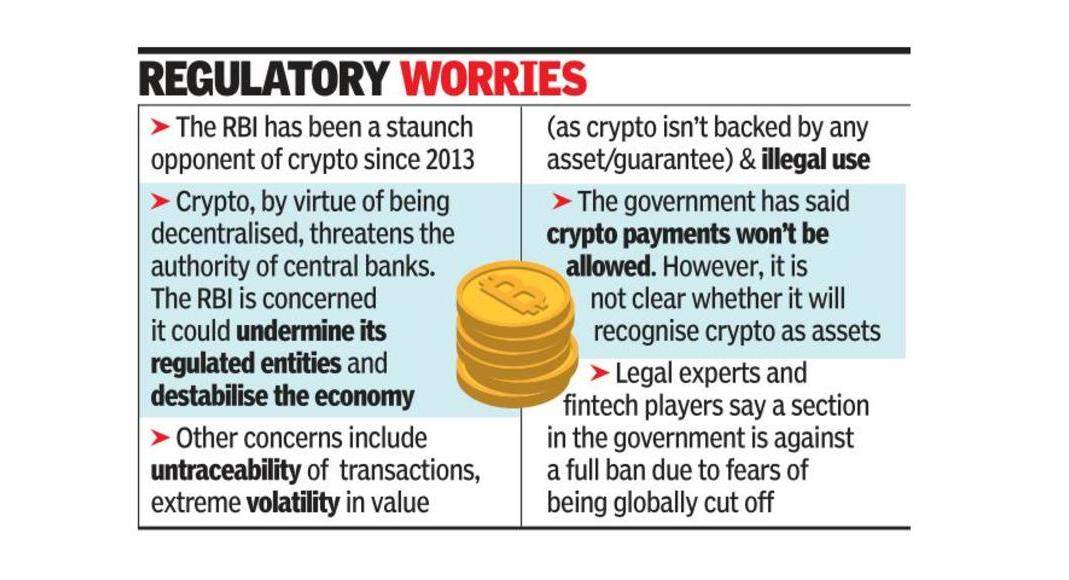

Eight years later, the central bank’s opposition to Crypto was only stronger.

Earlier this month, RBI told the council that ‘complete ban’ in Crypto was needed because partial restrictions would not work.

In 2018, the RBI has effectively prohibited Crypto trade in India because it ordered a bank not to facilitate it.

However, the Supreme Court’s ruling in 2020 set aside the central bank’s order.

RBI consistently opposes Crypto because it has concerns related to financial stability.

Central bank monetary policy will be less effective if Crypto is allowed to move freely.

Virtual currencies will also damage the bank and other regulated entities.

Another concern about Crypto includes volatility and difficulty of extreme prices in tracking transactions.

In addition, in countries like India, managing the risk of foreign exchange will be a bigger challenge considering that money will flow through the digital currency and not have to be in the form of dollars, the RBI source argues.

Even the chief economist IMF Gita Gopinath highlighted this challenge while showing that developing and developing countries faced greater threats.

The view from Mumbai’s Mint Road is that Crypto may not be treated as currency or assets, especially considering concerns over illegal distribution funds.

The government has not submitted his view given that all wings are not aligned with problems – something that leads to the introduction of the proposed law is postponed until at least the next parliamentary session.

According to Fintech players, a part of the government may conflict with a full prohibition because fear will be disconnected globally and exchanged with China, which prohibits Crypto this year.

Law experts say that, while recognizing Crypto as a legal tender out of the question, it’s too late to ban Crypto.

According to them, the government’s approach must be balanced so as not to hurt investors but at the same time did not let it grow uncontrollably because it could threaten the country’s foreign exchange reserves and led to disruption in the economy.

“The government is looking at Cryptocurrency as an investment instrument and plan to regulate it.

Under income tax rules, Cryptocurrency tends to be treated as assets and attracting capital profits.

GST and TDS are other areas where legal position is not clear,” said L Badri Narayanan, Executive Partners , Lakshmikuaran & Sridharan lawyer.

Law experts say that comprehensive regulations are needed and that it is unfair to compare policy attitudes that India takes Crypto with developed countries such as Britain, which takes the ‘rules little by little’ approach, because of differences in foreign exchange regulations.

“You can’t spend money from India without permission.

We are a market governed by foreign exchange and that means we cannot make certain decisions such as developed countries that have free markets,” Narayan said.

He added that it would be difficult for the regulator to stop the payment of Crypto by Indians abroad.

The Crypto industry has also been looking for clarity on foreign exchange and tax laws.

“Under FEMA (Act foreign exchange management), the cross-border movement of ‘goods’ and ‘services’ is classified as import / export.

However, the regulation does not clarify whether Crypto Token amounts to ‘goods’,” said Sumit Gupta, CEO & Co- Founder Coindcx, Crypto Exchange, and Co-Cure of Industry Body BACC.

Part in the government has suggested that Crypto can be arranged as an asset class by Watchdog Watchdog Sebi.

For this purpose, the bill in the cryptocurrency, along with some amendments to the RBI and ACTS SEBI, must be submitted in parliament.

However, the many awaited Crypto bills and other amendments were not introduced during the parliamentary winter session which had just been concluded.

Prime Minister Narendra Modi said new technology such as Crypto must be used to “empower democracy, not weaken”, while FM Nirmala Sitharaman said that Cryptocurrency would not be permitted for payments in India.