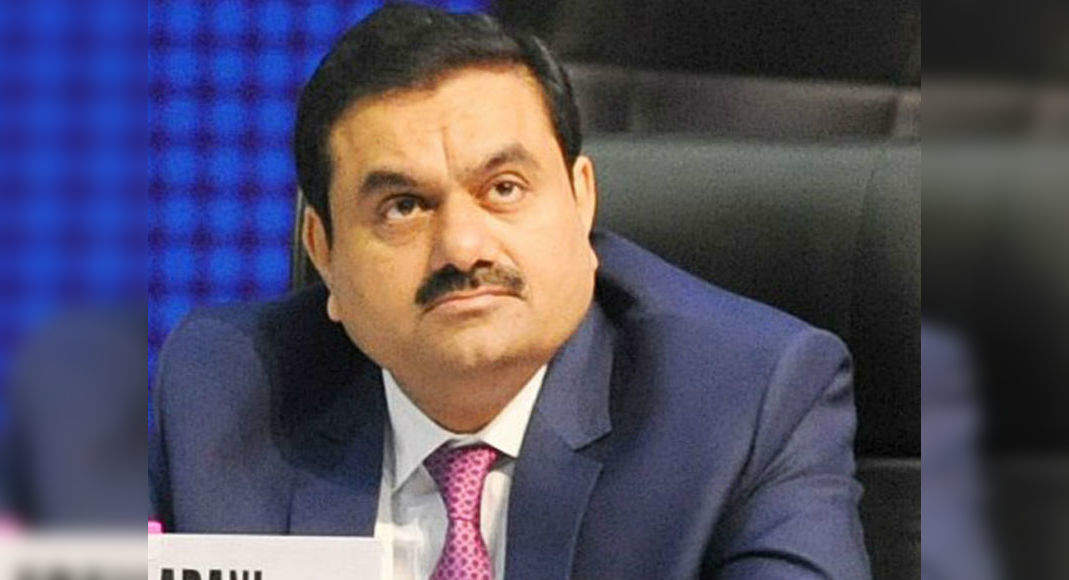

NEW DELHI: Confusion over three Mauritius-based capital that whipsawed stocks of firms dominated by Indian billionaire Gautam Adani this week’s underscored a more profound danger of investors in these stocks possessed with opaque entities.

Shares of Adani’s companies nosedived on Monday following a report stated reports of those funds — possessing roughly $6 billion of stocks throughout the conglomerate — were suspended by India’s federal share depository.

The Economic Times reported the activity was shot likely because of inadequate details about the consumers, citing people it did not identify.

The shares recouped losses following the conglomerate refuted it.

A Tuesday filing stoked doubts after Adani group explained the 3 capital were confronting some suspension because of a decades regulatory purchase.

Adani Total Gas Ltd, Adani Power Ltd and Adani Transmission Ltd all dropped by their 5 percent each day limitation at Mumbai on Tuesday.

Adani Ports & Special Economic Zone Ltd along with Adani Green Energy Ltd also slipped a bit.

Flagship Adani Enterprises Ltd dropped initially prior to turning the declines to close the afternoon with 2.5percent profit.

“It’s essential for investors as well as also the regulator to be conscious of the possession in listed firms, particularly when they arise from tax havens such as Mauritius,” explained Hemindra Hazari, an independent researcher at Mumbai.

“The titles of the capital aren’t very well-known from the funds market and they’ve got high immersion to a multitude of shares, and in itself is odd.” OpacityEven as a large share rally at the businesses of this ports-to-power conglomerate has this year more than doubled the net value of Adani — a first-generation entrepreneur — about $73 billion, even the week’s events have led to some deeper pain stage: opacity round the team and its crucial non-founder shareholders.

There is also scant analyst policy for Adani businesses, highlighting that the data lacunae might be a recurring problem.

Read AlsoWhy stocks of Adani Group dropped sharplyThe stocks of Adani Group businesses suffered a large shock on Monday.

All shares of this group struck their individual reduced circuit limitations throughout the trade leading to enormous loss of greater than $6 billion in a single day.The Economic Times said on Monday that the National Securities Depository Ltd froze the report Albula Investment Fund, Cresta Fund and APMS Investment Fund.

The Adani team denied that the report also called it”blatantly incorrect” in an announcement Monday but explained Tuesday that the three demat reports of Cresta, Albula and APMS have been”suspended for banking,” adding to the confusion on the condition of the overseas capital.

“It’s very critical for the Adani Group to disclose important details about eventual beneficial ownership of international portfolio investors holding significant shares of its group firms,” explained Zulfiquar Memon, managing associate of Mumbai-based law firm MZM Legal LLP.

Disclosing these particulars is required”as a part of becoming transparent,” he explained.

A number of Adani team’s recorded stocks have jumped over sixfold in value since the beginning of 2020 on stakes that Adani’s gigantic drive into infrastructure will repay as India seems to rekindle the virus-ravaged market.

Adding into the tailwind has been MSCI Inc.’s choice to add three additional Adani stocks into its India benchmark indicator, taking the total to 5.

That usually means any finance indexed for this gauge is going to need to purchase in these stocks.

The indicator suppliers may decrease the free-float of all Adani stocks within their calculation, based on Brian Freitas, also a New Zealand-based adviser on individual study supplier Smartkarma.

This may result in a selloff of approximately $515 million value of stocks by passive capital, Freitas stated.

“Whenever there’s a lack of transparency, then it’s better for investors to keep off,” Hazari stated.

‘Concentrated positions’The rapid surge from the stocks at yesteryear along with equity mostly held by foreign funds with hardly any public float is a danger for Adani stocks, Bloomberg Intelligence analysts wrote .

One of the largest foreign investors are a couple of Mauritius-based capital holding over 95 percent of resources in those firms, Gaurav Patankar and Nitin Chanduka composed at a June 10 note.

See AlsoAdani Group says record of freeze foreign funds’blatantly incorrect’Adani Enterprises Ltd said on Monday that press reports about freezing accounts of foreign funds that had spent in the group firms were”blatantly incorrect.” “Such concentrated places, together with minimal onshore possession, produce asymmetric risk-reward as big investors reluctantly avoid Adani,” that the BI analysts stated.

However, Adani, 58, is regarded as a survivor of disasters.

Over two years before, he had been tortured and held for ransom.

In 2008, he had been one of the hostages in Mumbai’s Taj Mahal Palace resort throughout the terror attacks that killed at least 166 individuals.

Since that time Adani has improved sharply by dovetailing his band’s business priorities together with India’s wider development drive.

And that is the pivot that has attracted in investors.

Regardless of the volatility,”the business stays in very great monopoly-like companies,” said Sanjiv Bhasin, a manager at investment management company IIFL Securities Ltd at Mumbai.

“Volatility is that there but underlying principles of this group stay strong.”