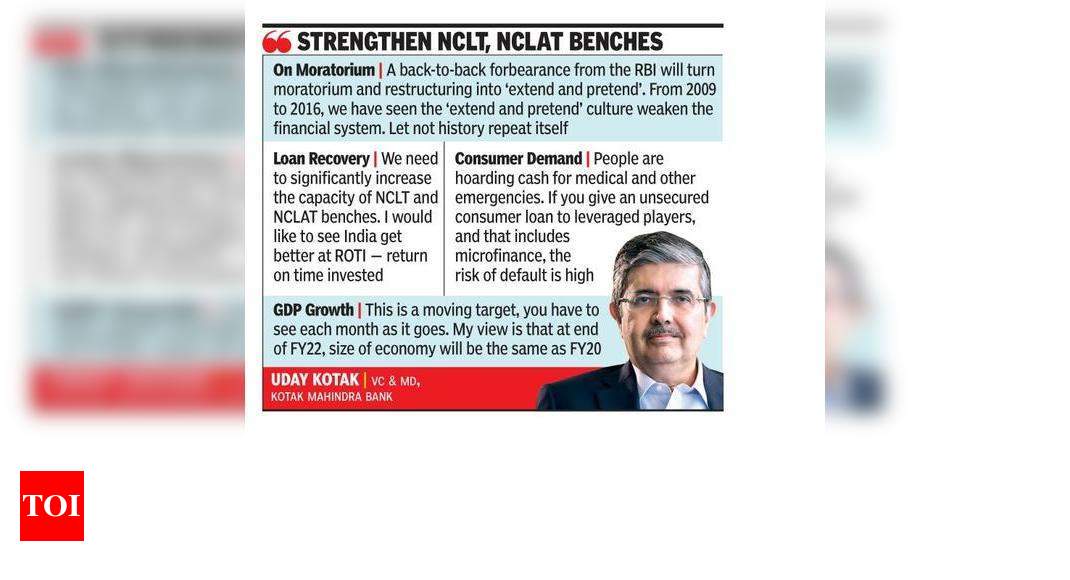

Kotak Mahindra Bank vice-chairman along with MD Uday Kotak, who’s also the former president of business body CII, believes that countries should calibrate opening upward while strengthening health vaccinations and infrastructure. He calls for financial support to assist little companies and the corporate industry wave over the brand new fiscal challenge. Excerpts: How should countries calibrate up the opening? How are businesses intending to restart operations? Our decision needs to be predicated on specialists, wisdom and science. The things which will function in the subsequent three-four weeks is the amount of vaccination. Among the classes which Covid 2.0 has taught us is that if there’s wastage, we have to make capability in hospital beds, air and medicine, as opposed to conduct helter-skelter as most Indians did. We’re three-four months off from a degree of assurance where we could have a daring call that we’ve vaccinated a great deal of individuals. From August, we must be vaccinating around 15 crore doses per month. On opening upward, nations will maintain a really challenging place between July and September. It is going to also be dependent on how effective the vaccine is contrary to the variations. What type of service will companies need in three-four weeks? Apart from a calibrated opening , we are in need of an overview of this policy coverage. We ought to consume two vaccine quotas — just one for the Centre, that need to be about 75 percent, and the rest to the private industry. The Centre must allocate equitably into the countries, differently, says competing with each alternative is producing any confusion. What’s your prescription to assist companies getting struck financially? The time has arrived to your fisc to measure and there’s very good news on this. The Budget was quite conservative on earnings. As an example, there’s Rs 50,000 crore more from the RBI. There’s space for the authorities to offer support to people in the base of the pyramid who want food and a few quantity of money for their own livelihood. I’d strongly suggest the ECLGS (Monetary Credit Line Guarantee Scheme), that has been for Rs 3 lakh crore, ought to be enlarged to Rs 5 lakh crore along with the warranty can empower financing of small companies and worried sectors. Should authorities devote more in the kind of direct gains as aid package? This moment, we ought to be bolder since the effect was on rural locations. The RBI must enlarge its balance sheet so the extra market borrowing doesn’t reach on the bond markets. Some creditors also have known for a moratorium… The lead transfers will take good care of poorer sectors and government assistance to MSMEs and expansion of ECLGS will safeguard projects and make it feasible for banks to give them. If a worried borrower doesn’t have monetary aid, the lender will magnify the loan when it warrants the loan as a NPA (non-performing asset) and supplies it. In the past calendar year, banks have increased substantial funds, making them space to restructure loanstake the provisioning hit and proceed. A back up forbearance in the RBI will turn moratorium and restructuring to’stretch and feign’. By 2009 to 2016, we’ve observed the’expand and feign’ civilization weaken the fiscal system. Don’t history repeat it self. Can the lockdown hurt banks by raising bad loans? April was fine. May is revealing anxiety and some of it’ll spill over June. The NPA effect will likely be felt only in the next quarter. The great thing is the equity markets are working and ready to offer capital. This will provide banks which require capital the capacity to lift it, require a knock and encourage the machine. Can there be concerns one of corporates to make investments? If potential utilisation in the market is 63 percent, then there’ll not be any growth. The minute funding utilisation will visit 75-80percent, and you may notice investment. My personal opinion is funding expenditure cycle is really a FY22-23 occurrence. Will need be struck by banks turning careful on unsecured loans? Consumer demand is becoming affected because people are hoarding funds for health and other emergencies. Should you give a unsecured consumer loan to leveraged gamers which contains microfinance, it’s a vulnerable section and the probability of default is very high. Does anything have to be performed on loan recovery/resolution? We will need to significantly boost the ability of NCLT and NCLAT chairs. We will need to concentrate in time. When there’s 1 thing, I’d love to see India get better in it’s ROTI — return on time spent. Can you find that the GDP goal being accomplished? That can be a shifting target, you need to find each month since it belongs. My opinion is that in the conclusion of FY22, the dimensions of this market is going to be just like FY20. Any expectations out of credit policy? The RBI was proactive during the period as April 2020. The time has arrived for a few of the significant liftings to be carried out by this fisc. The RBI can encourage the authorities by enlarging its authorities safety (G-sec) purchase programme. Our investigation shows inflation will soon be under management of 2021 and the RBI will soon be in an accommodative position and support the market. Can GST cut assist to market demand? No matter the authorities can perform out of its fisc to encourage customers and the wider economy is still welcome.

Calibrate opening-up of Eco-friendly Friendly with vax, ” Says Kotak