New Delhi: The center on Wednesday slashes Customs on gasoline and diesel amounting to RS 5 and Rs 10 per liter, a step that will offer assistance to consumers by reducing pump tariffs and reducing daily prices for ordinary people.

The deductions will reduce the price of gasoline around Rs 6 per liter and diesel by around Rs 12 in Mumbai from Thursday, assuming retailers do not increase the base price.

Reduction will vary in other states according to the level of VAT collected.

The state with higher VAT will see a reduction in pump prices which are slightly higher.

The higher PassThrough is due to an additional decline in state levies because VAT is charged after excise duties and dealer commissions.

Taking cues, the upper government, Gujarat, Goa, Karnataka, Uttarakhand, Assam, Manipur, Tripura, and Bihar cut PPN on fuel.

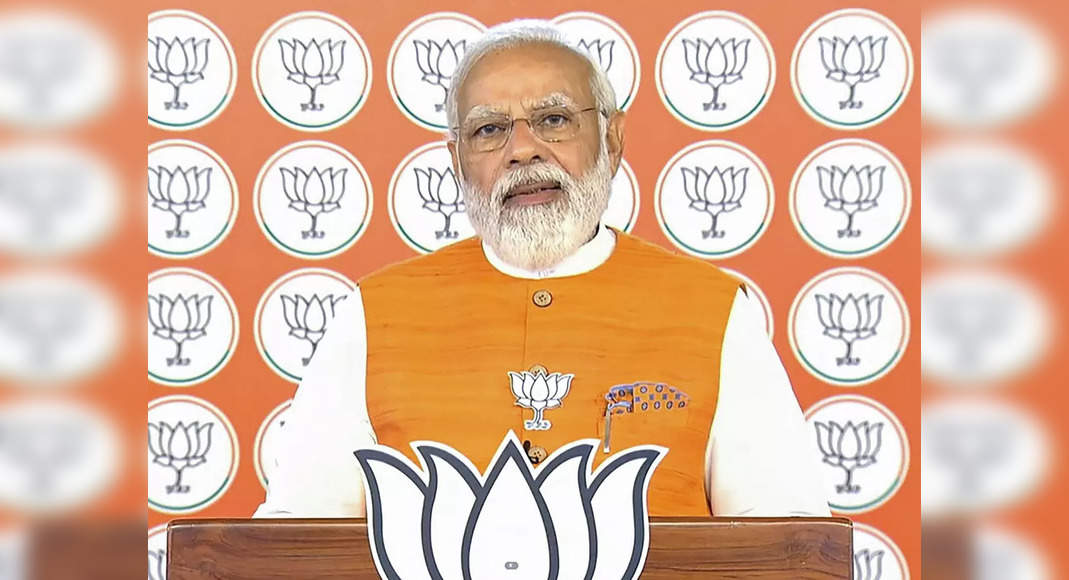

BJP regulates all these states, except Bihar where it is at the Alliance with JD (U).

UP, Goa, Uttarakhand, Gujarat and Manipur will conduct a poll next year.

The steepest customs of customs will reduce the leverage of opposition to BJP for fuel tax issues and price increases.

However, it will leave the hole around Rs 60,000-65,000 Crore in tax collection in the remaining fiscal months.

Oppn Slams The government because it does not fully roll back the Levieshighher mop-up with other taxes is expected to bridge this gap.

The Ministry of Finance’s statement said the reduction in customs is higher in diesel, the main fuel for the agricultural and transportation sector, will help farmers in the upcoming Rabbi season.

It is interesting for countries, which have also gathered VAT when crude oil prices fell, to match the central steps by reducing VAT to eliminate consumers.

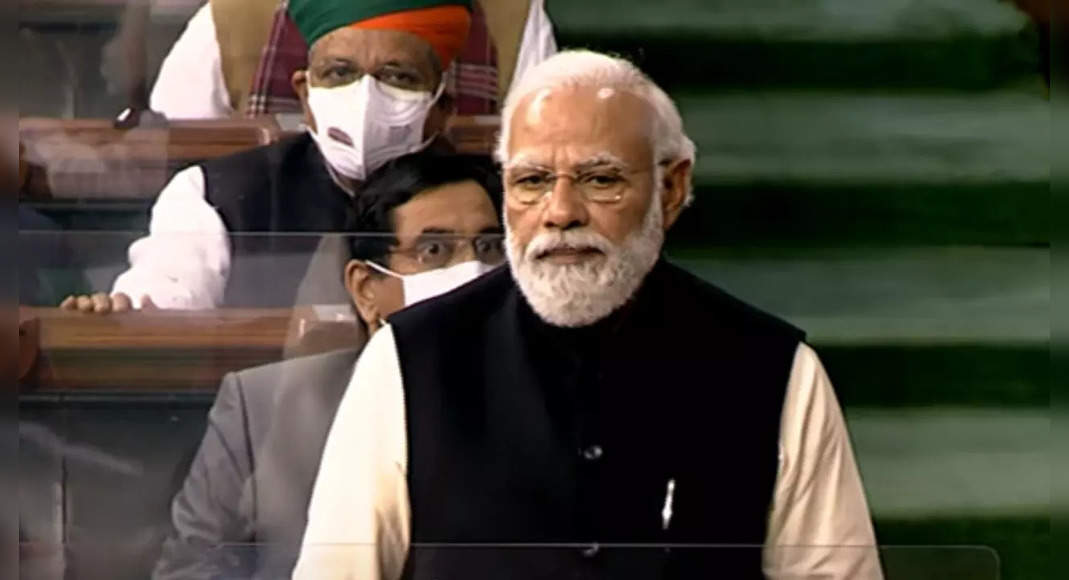

“Indian farmers have, through their hard work, maintaining the momentum of economic growth even during the locking phase and massive reduction in excise in diesel will come as a boost for farmers during the upcoming Rabbi season,” he said.

However, Congress and other opposition parties such as TMC, slammed.

The government did not completely roll back higher levies that kicked after the Covid outbreak in 2020.

In addition, there was a criticism that the reduction of customs centers would also reach the state because they had a center share of 41.5%.

The critics suggested that the center should have a CESS reduction that was not shared with countries.

The center has raised excise assignments of Rs 13 on gasoline and RS 16 on Diesel between March and May last year when oil prices collapsed because of a pandemic.

The two rises have increased excise duties of 65% on gasoline from Rs 19.98 to Rs 32.98 per liter and 79% on diesel from Rs 15.83 to RS 28.35.

Increased customs duties swelled central fuel tax collection by 88% at 2020-21 to more than RS 3 Lakh Crore even though sales were lower in the middle of a pandemic.

A collection of tasks from Diesel alone has jumped 108% due to higher taxes.

Because crude oil prices began to increase in recent months, high taxes strengthen the impact and push the price of pumps to a record level.

The price of gasoline is currently in power above the 100-liter Hospital in almost all countries and diesel sales for as much as possible in countries with high VAT and floating near all states.

The recording pump price has given inflation pressure, the statement said.

“The world has also seen the shortcomings and price increases of all forms of energy.

The Indian government has made efforts to ensure that there is no lack of energy in this country and that commodities such as gasoline and diesel are available adequately to meet our requirements,” said the statement.