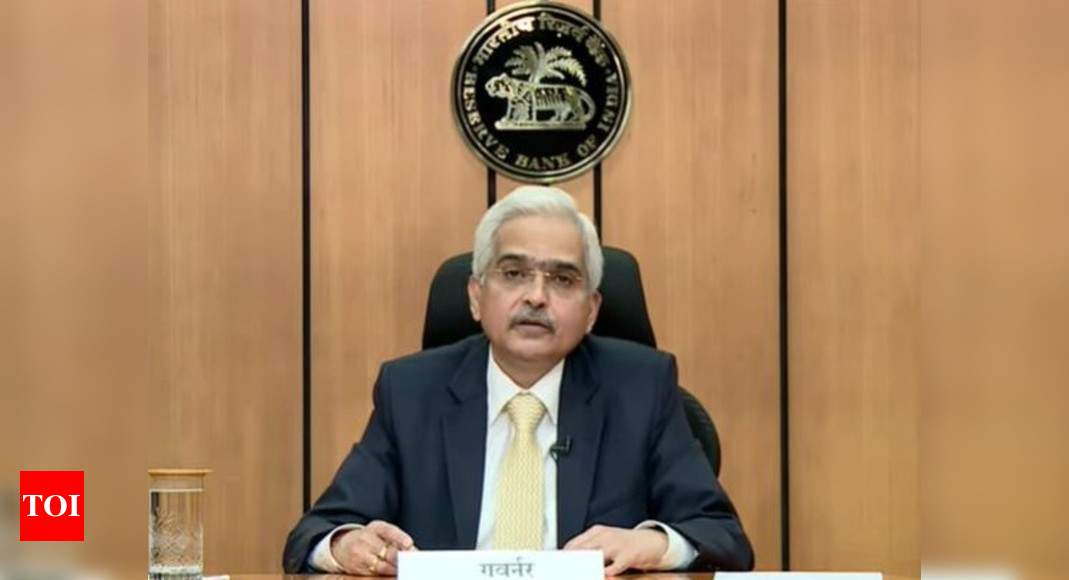

MUMBAI: The Reserve Bank of India (RBI) governor Shaktikanta Das on Tuesday requested private sector banks to guarantee continuity in the supply of different financial solutions, such as credit facilities to people and companies, in the face of challenges caused by the outbreak. Before that month, the Senate had held that a similar meeting with MD and CEOs of public sector banks. During the interview with the MD and CEOs of choose private sector banks,” Das also impressed with the banks to rapidly and quickly implement the steps announced by the RBI on May 5, 2021, at right earnest. On May 5, the Senate had declared a slew of measures, such as term liquidity center of Rs 50,000 crore to facilitate access to emergency healthcare services. They were aimed to further enhance lending to the MSME sector, restructuring of loans, and rationalisation of compliance with KYC, in aftermath of this next wave of this Covid-19 pandemic. “He (Das) also advised that the banks to guarantee continuity in supply of different financial solutions, such as credit bureaus to people and companies, from the face of obstacles caused by the outbreak,” the RBI said in a statement. The company also urged them to keep on focussing on attempts to strengthen their balance sheets . Throughout the meeting held during video conference, additional issues which were discussed included evaluation of the present financial situation and the condition of the banking industry; credit flows into various parts of the market, especially for small borrowers, along with MSME. According to the announcement, advancement in the execution of this Covid-19 Resolution Framework 1.0; fiscal policy liquidity and transmission situation; and Implementation of different Covid-19-related policy steps taken from RBI, also came up for debate. The meeting was attended by deputy governors M K Jain, M Rajeshwar Rao, Michael D Patra and T Rabi Sankar.

Ensure continuity of Different financial Solutions: RBI guv to banks