New Delhi: Cooperative banks in India have faced severe challenges in their survival.

This problem came to the center of attention, especially after Punjab and Maharashtra Co-operative (PMC) Fiasco, who left depositors roaming branches for efforts to withdraw the money obtained.

Over the years, such banks have escaped the supervision regardless of failure and fraud, being under the double regulation of the community registrar and the reserve of the Bank of India (RBI).

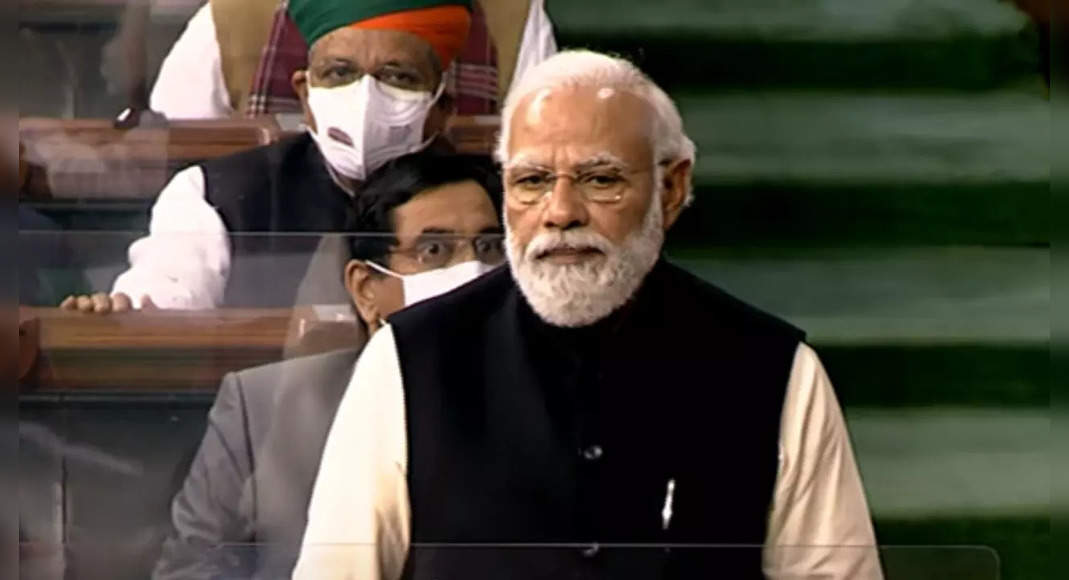

However, Parliament approved the amendment of banking regulations in September last year as a result of the cooperative bank was brought under the supervision of the RBI.

As a result, 1,482 Urban Cooperative Banks and 58 multi-state cooperative banks where brought under the direct supervision of RBI.

It gives adequate strength to the central bank to control cooperative banks in the same way as overseeing the scheduled cooperative bank.

It will also say in the main promises.

Cooperative banking structure in the trend and the progress of banking in India per RBI, there are 98,545 cooperative banks in this country.

The cooperative bank is further classified into urban cooperative banks (UCBs) and rural cooperative banks.

At the end of March 2020, this sector consisted of 1,539 UCBS and 97,006 rural cooperative banks, with a basis of 8.6 crore depositors.

UCBS is further classified into the scheduled UCB (54) and UCB which is not scheduled (1,485).

Meanwhile, rural cooperatives consist of a cooperative bank (33), district center cooperative (363), primary agricultural credit community (95,995), agricultural cooperative state and rural development bank (13) and operating co-agriculture and rural development banks ( PCardbs).

Why changes to cooperative sectors face certain financial challenges during 2019-20 with fraud episodes that affect the quality of assets and profitability of Urban Cooperative Banks (UCBS).

In addition, the emergence of Covid further influences the operation of this sector, said Reserve Bank in the quarterly trend report.

LAX corporate governance standards combined with political influence and disruption are the main reasons for the fall of this sector.

Last year, Minister of Finance Nirmala Sitharaman told Lok Sabha that the financial status of at least 277 UCB was weak, and around 105 cooperative banks could not meet the requirements of the minimum regulation capital.

He also stated that the net wealth of 47 negative banks, and 328 urban cooperative banks had gross non-performance assets of more than 15 percent.

Amendments become more important after PMC bank disaster becomes the center of attention.

Decreasing no.

UCBsafter Bank Reserve Bank license license policy for UCBS in 1993, almost a third of the newly licensed becomes financially unhealthy in a short time.

Of course! function () {“use tight”; window.addeventListener (“message”, (function (e) {ifo (void 0! == e.data [“datawrapper-high”]) {var t = document.quereselectorAllaGnead (“iframe”); for (var a in E.Data [“DataWrapper-Height”]) for (var r = 0; r