New Delhi: Parliamentary Panel has shown footprints that fall from the central flagship plant insurance scheme and express concerns over the withdrawal or non-implementation in seven countries, said more such examples in the following years and “delay in the solution to claim” will defeat its purpose .

The Committee in Agriculture, in his report lay on Lok Sabha on Tuesday, said that most of the withdrawal countries carry out their own schemes, the central government must correctly look into the reasons / factors that lead to withdrawal or non-implementation of the Pradhan Mantri Fasal Bima Yojana (PMFBY).

Punjab has never joined the central plant insurance scheme, which provides insurance protection to farmers on plant losses due to natural disasters, while Bihar and West Bengal have been withdrawn from it in 2018 and 2019.

On the other hand, Andhra Pradesh, Gujarat, Telangana and Jharkhand did not apply last year’s scheme.

Countries quote “financial constraints” and “low claims ratios during the normal season” as the main reason for non-implementation schemes.

PMFby was launched with the effect of April 1, 2016, after playing back the previous scheme to enter more risks under plant insurance cover and make it more affordable for farmers.

It was very well received by farmers in the first year.

The coverage is 30% of the Gross Harvest Area (GCA) in 2016-17 – the highest coverage in the history of plant insurance in India.

But then, it decreased to 27% in 2018-19 and 25% in 2019-2020.

Records, referred to by the panel, indicating that coverage in terms of insured areas under PMFBY decreased from 567.2 lakh hectares in 2016-17 to 508.3 lakh hectares in 2017-18 and then 497.5 lakh hectares in 2019-20 .

The withdrawal of the state from the scheme was quoted by officials as one of the reasons for decreasing the scope of the scheme.

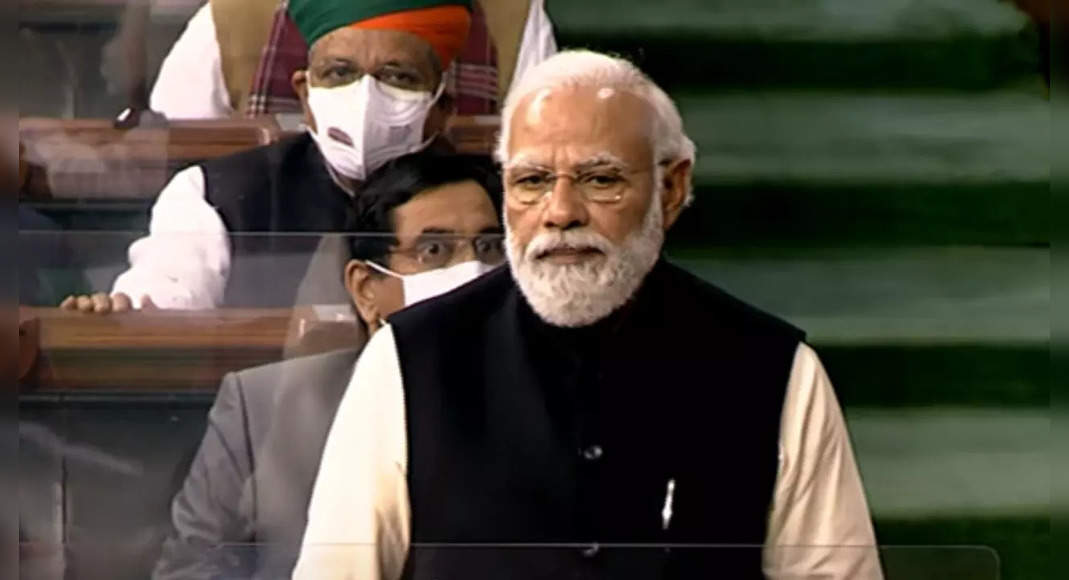

Marking the problem of delays in settlement claims, panels, led by BJP Lok Sabha PC member Gaddigoudar, said farmers utilizing insurance under PMFby in the hope that it would help in mitigating their losses at times.

“But the delay in the settlement of claims defeats the purpose of this scheme.” Although the ministry has made the provisions of a 12% density per year that must be paid by the insurance company to farmers for delays in the completion of the claim exceeding the 10-day cut-off date specified for the payment – it has not been resolved.

Under PMFBY, farmers need to pay a uniform maximum premium of only 2% of the insured amount for all Kharif plants (sprinkled in summer) and 1.5% for all rabbi plants (winter).

In terms of commercial and annual horticulture plants, the maximum premium that must be paid by farmers is only 5%.

The balance premium is borne by the government, both distributed by the state and the center.