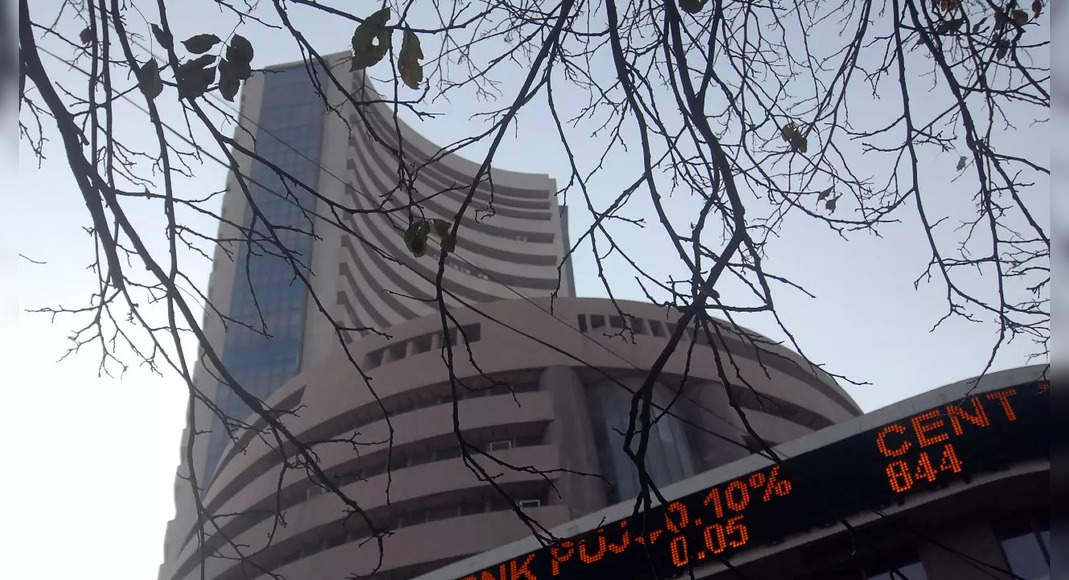

New Delhi: Foreign Portfolio Investor (FPIS) is a clean seller on the Indian market for RS 949 Crore songs in the first half of November.

In accordance with deposit data, they issued a 4,694 crore RS from equity between November 1-12.

At the same time, they pumped RS 3,745 Crore in the debt segment.

This was translated into the total clean withdrawal of RS 949 Crore.

In October, FPI remained clean seller at Rs 12,437 Crore.

FPI has been worried about higher Indian equity assessments, which continues to trade near the high level of all time, said Himanshu Srivastava, Director of Associate – Manager of Research, Morningstar India.

FPI sits in profit, will choose to order the same as reflected in the flow trend over the past few weeks, he said.

In addition, concerns over global inflation pressures and a slowdown in several advanced economies are also a concern, he said.

“It seems that the FPI comes out of the assessment concern.

The important point that needs to be considered is that the old scenario where FPI represents the market trend determined by the smart money ending for now …

we are in a period of uncertainty,” Vk Vijayakumar said.

Head of Investment Strategy in Geojit Financial Services.

For the debt segment, Srivastava said, “the trend of flow is mostly driven by the direction of USD and US treasury yields.

FPI tends to park their investments in Indian bonds for the short term when they adopt the waiting approach with Indian equity..” FPI flows on Posted in November so far for Indonesia, Phillipines, South Korea, Taiwan and Thailand to USD 78 million, USD 47 million, USD 203 million, and USD 59 million, recorded Chrikant Chouhan, Head of Equity Research Retail, Securities box.

In the future, Chouhan said the FPI flow might remain fluctuating in developing country markets because of the sharp increase in global energy prices and the prospect of price increases can lead to global and domestic risk sources.