Mumbai: Ahead of the Proposed Mega Public Offering (IPO), the government is looking at ways to harmonize life insurance companies on Indian rules (LIC) for the distribution of surplus to shareholders with what applies to private companies.

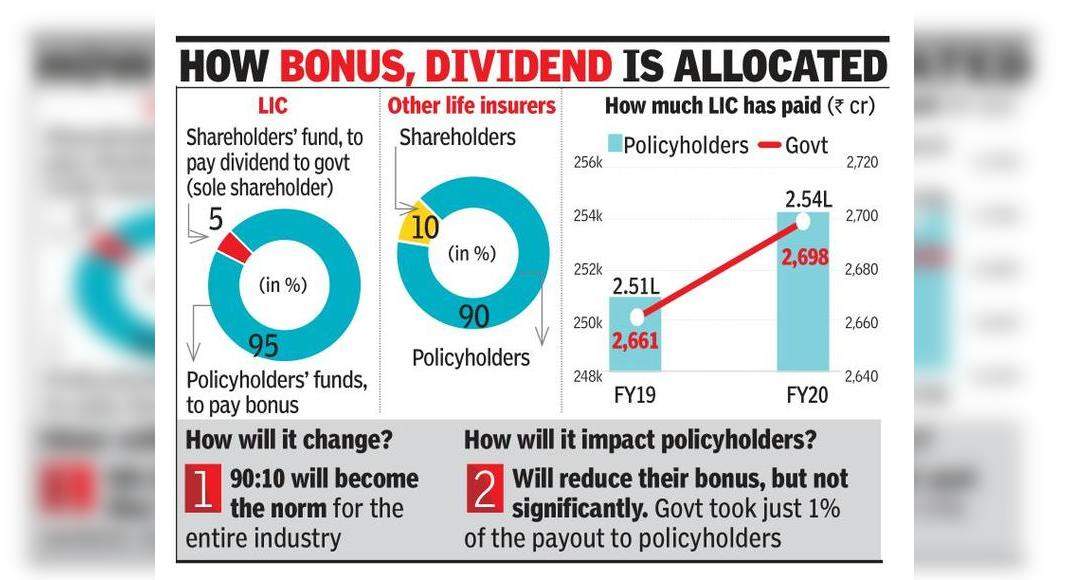

Currently LIC, which is regulated by a special law, is permitted to transfer 5% of surplusus with shareholder funds.

The remaining 95% goes to policyholder funds to pay a bonus on the eligible life insurance policy.

In the case of other life insurance companies, which are regulated through insurance laws, the allocation is permitted in the 90:10 ratio.

With the IPO planned in the fourth quarter of the fourth fiscal, the government intends to bring parity to make investment into an interesting LIC proposition, the sources that are familiar with the deliberation to TII.

“It’s only natural that investors will expect a similar structure.

We are working on the details, along with some other changes,” said the government’s source.

This center hopes that this will help balance the interests of shareholders and policyholders and still make an IPO appeal to investors.

The government is also expected to clarify the level of foreign investment that will be permitted in the company after the listing.

At present, up to 74% of foreign direct investment (FDI) are permitted in the insurance business, but it is expected to be regulated by a special dispensation.

Surplus of LIC assessment arrives after calculating all obligations in connection with the borne business.

This means that policyholders with futures insurance, guaranteed return policies and unit-linked plans will not be influenced by dividend distribution policies.

Only participating policies where benefits are determined by the bonus level that will be affected.

According to industry sources, changes in the payment ratio will not make a significant difference for policy holders as, say, reduction in the RBI policy rate.

For private companies, the benefits of sales protection are also a significant part of their profits.

Every surplus that a private insurance company made from sales protection is fully policy holder.

In the case of LIC, the benefits are divided between the government and other policyholders.

Changing dividend distribution policies will benefit shareholders but can, once again, impact on the existing participating policyholders.

The government believes that some individuals who have bought a blanket of life from the insurance giant will also buy LIC shares during the IPO because certain percentages of this problem will be provided for them.

This will give their rights to dividends in the coming years.

For LIC policy holders, the biggest attraction is that whatever promised in the policy will continue to be guaranteed by the government.

The government, while changing LIC law, has maintained part 27, which states that the amount guaranteed by all policies issued by the corporation – including each bonus stated in connection with it and all bonuses – guaranteed as cash payments by the central government.

A senior government official said that the Department of Investment and Management of Public Assets will overcome the details of the proposed problems based on the embedded value which is currently being worked on.