Nagpur: Pandemic has become an eye opening for thousands of citizens who have never bought health insurance protection.

Because the cost of Covid-19 maintenance running to Lakh, many have to lose the balance of banks, savings, gold ornaments and property.

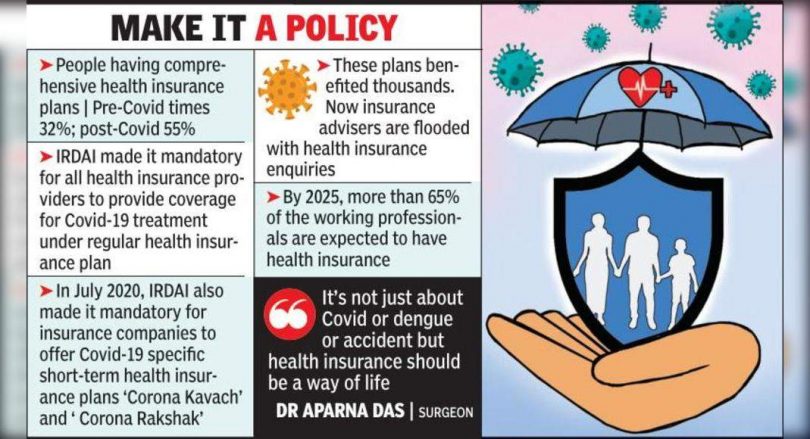

After the second wave, a surge in investigating health insurance was seen and many young professionals would carry out a comprehensive health policy.

According to Tijare Shrikant’s financial advisor, it has increased by a minimum of 30% about questions for health insurance.

“Previously, people used to ask for investment options.

Now, inquiry first they are health insurance.

Many young professionals buy protection from RS5 Lakh to RS10 Lakh,” he said.

Tijare further said that during a health check it was carried out for the policy, many know about their illness, they did not realize it.

“Most insurance companies conduct pre-policy health checks and when many diseases such as hypertension and diabetes are diagnosed before they can change seriously,” he said.

The doctor also welcomed this change.

“It’s like a hidden blessing.

People have realized the importance of health insurance as never before,” said Cardiology Dr.

Amar Amal.

Mental Peace, said Dr.

Amale, is the best offer of health insurance policies.

“In the Covid Times, the replacement under insurance returns money into the bags of depressed people.

Even the hospital makes peace when the patient is borne by insurance because the family that has been stressed does not need to be asked every day for money,” he said.

Rakshit Patel insurance advisor explains the simple formula that underlines how profitable life insurance.

“It’s like paying RS10,000 per year, which means RS1 Lakh in 10 years, because of insuring the entire family for RS5 Lakh per year.

If anyone from the family needs to enter because Covid, dengue fever or accident, your annual investment will include the number of bills , “he said.

“Health insurance also makes people assure that they have RS5 Lakh cover.

So it is a win-win situation,” he added added that even unavoidable diseases such as cataracts, knees or hip replacement etc.

are included under insurance today.

“So, you won’t lose when you insure your health,” he said.

Sharing his experience during the second wave of Covid-19, the Dahuake Pressur businessman said, “I was treated at a private hospital for 10 days and a bill more than RS2 Lakh.

I have a short-term Corona Kawach policy.

I was close to RS1.50 Lakh replaced.

That Large pause, “he said.

Surgeon Dr.

Aparna watershed emphasizes that it is not only about covid or dengue fever or accident but health insurance must be a way of life.

“Having a health cover is one of the biggest lessons Covid-19,” said Dr.

Das.