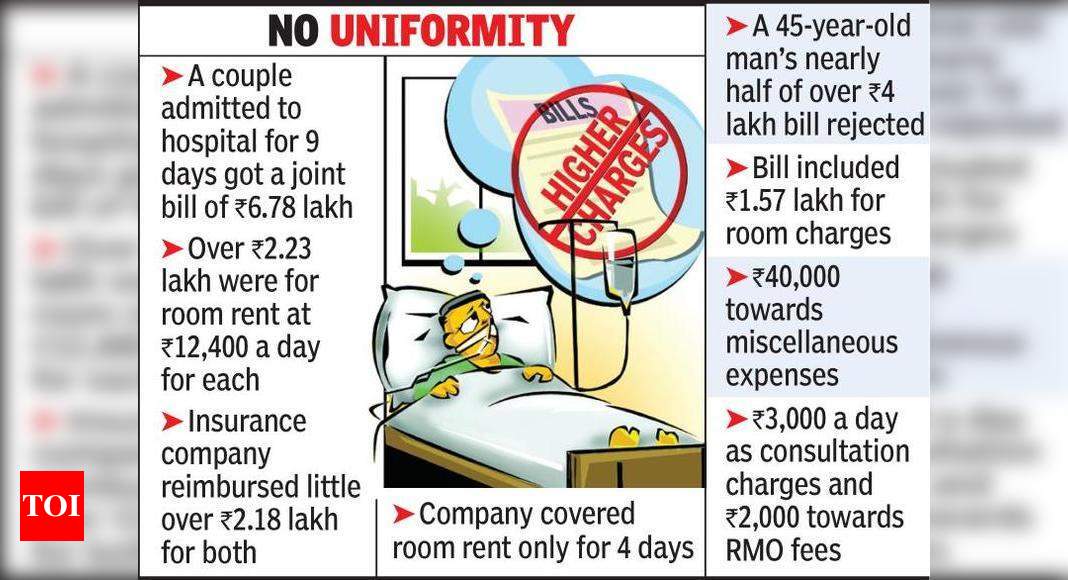

Nagpur: Dinkar Garg and his wife were admitted to a private hospital near Wadi after contracting Covid at March.

For nine-day remain, the number was passed over a joint charge of Rs6.

78 lakh.

This comprised within Rs2.

23 lakh towards area lease alone in Rs12,400 per day, for every one of these.

The insurance company reimbursed a bit over Rs2.

18 lakh for the two.

The insurer covered area rent just for four times from nine.

The reason mentioned was that the remain for the following five days wasn’t required, but the hospital maintained them.

The hospital also had billed Rs28,800 to get PPE kits, that had been completely rejected by the insurance company.

Just Rs16,000 was reimbursed from Rs42,000 as physician’s fees.

In the event of a 45-year older guy getting admitted into a upmarket hospital at October this past year, almost half of those over Rs4 lakh invoice was reversed.

The invoice contained Rs1.

57 lakh for space fees, Rs40,000 towards miscellaneous costs, Rs3,000 per day as appointment fees and Rs2,000 towards resident health officer (RMO) fees.

The insurance company reimbursed just half of this space rent, miscellaneous costs were entirely disallowed together with RMO fees and Rs1,000 per day has been allowed for consultation charges.

Since TOI analysed half a dozen statements from other institutions, it had been seen as much 50 percent of the costs have been rejected by insurance companies.

Over fifty percent of the invoice amount was towards area fees, followed closely by disposables, aside from another mind of miscellaneous fees which had considerable quantities.

The RMO prices were in the Array of Rs1,000 into Rs2,000.

Insurers generally didn’t let over Rs6,000 per day as space rent, as costs below a complete array of minds are completely rejected.

This is yet another illustration.

A patient has been billed Rs15,000 per day for two weeks towards area lease, though he had been retained in overall ward.

The hospital charged over Rs37,000 to get PPE kits aside from Rs4,500 for masks individually.

Throughout the two weeks, the individual has been billed Rs1,050 to get four PPE kits a day.

The expense of mask has been Rs100 each.

From the complete invoice of Rs2.

93 lakh, the individual has been reimbursed Rs1.

34 lakh.

Including Rs25,000 obtained following an attempt to reconsider the situation has been made into the organization.

TOI obtained another invoice that hasn’t yet been settled yet.

The patient had been admitted for five days from April.

Even the Rs3 lakh bill comprised Rs70,000 towards inspection fees.

Two physicians billed Rs7,000 daily for 5 days.

The area lease, nursing fees and also RMO fees clubbed rack in Rs1.

4 lakh.

In a few statements of over Rs1 lakh, Rs60,000 into Rs65,000 were permitted.

Among those patients obtained full settlement of Rs20,000 as area fees, the other obtained Rs7,200 as from Rs9,200 billed for per day.

Health insurance advisor Manoj Aya explained,”The invoices have significant charges towards area lease, disposables, nursing or RMO fees.

Some hospitals are such as biomedical paychecks fees also.

Many insurance companies are letting space rents just around Rs6,000, while completely rejecting lots of elements.

This has generated disputes between businesses and customers.

The invoices are accepted by a group including physicians from the firms’ side.

Disputes may be raised using an insurance ombudsman or customer courts, stated an adviser.

Hosp Suggests, Insurance Company disposes: Cos reject Almost 50 Percent of Fees paid by patients