Mumbai: The total investment by Indian Mutual Funds (MFS) in stocks listed abroad jumped more than three and a half times during the financial year of 2021 (FY21), increased mainly by a record of rally in most fiscal global equity markets.

This is partly assisted by several new funds launched by MF domestically during the year.

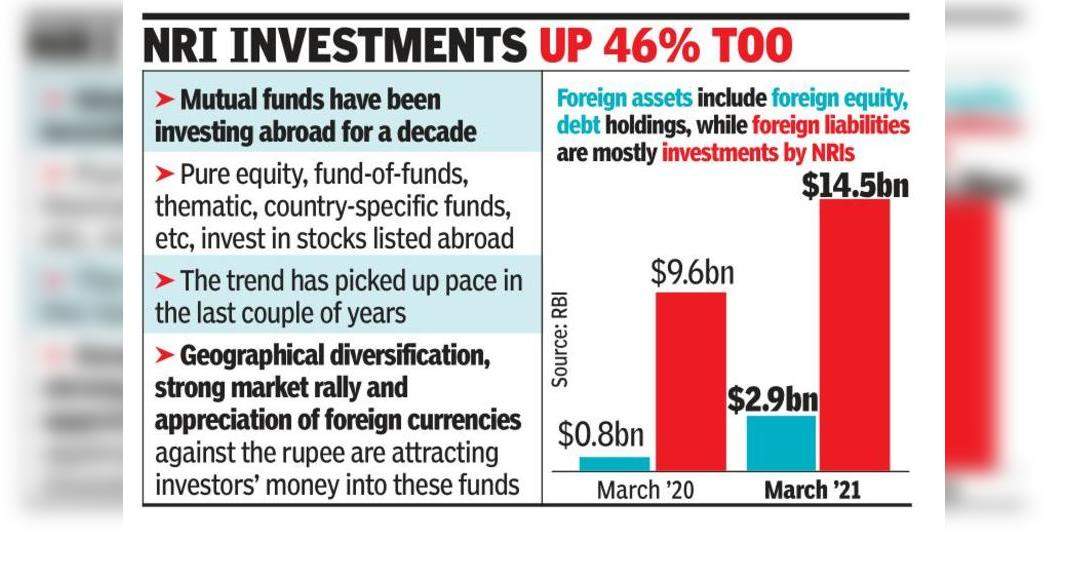

From Rs 5,808 Crore at the end of March 2020, the total foreign assets of Indian Fund house surged to RS 20,865 Crore at the end of March 2021, the data released by the RBI showed.

However, the net overseas obligations of Indian funds, however, showed an increase of only 28% during FY21 to RS 85,267 Crore.

There are several MF schemes in India who invest in stocks listed abroad and trends suddenly picked up in recent years.

These include pure equity funds that invest part of their corpus abroad, and also international funds that invest abroad through funds (FOF) and the Fund-Traded Fund (ETF) structure, thematic funds, state-specific funds, etc.

Geographical diversification, strong market rallies in recent years and the appreciation of foreign currencies to Indian rupees is one of the most interesting reasons for Indian investors to put their money in these funds, industrial players said.

In addition, the negative correlation between the Indian market and those abroad can also be an excuse for Indian investors to put their money there, the source added.

According to the RBI, most of the money investors investors investors overseas is concentrated in two countries – US, which accounted for 43.3% of the total corpus, while 42.5% were in Luxembourg.

Distributed balances between Ireland, Japan, Canada, and several other countries.

The data of the central bank also shows that the responsibility of the total MFS India increased in TA21 around 46% to almost Rs 1.1 lakh crore.

This liability is mainly in the form of units incurred for non-residents.

Together, this caused the net obligation of Rs 85,267 Crore at the end of March 2021 – up about 28% over the FY20 figure.

Among the dedicated international funds, the NASDAQ 100 ETF Motilal Oswal MF is the largest with the Corpus RS 5,125 Crore, data from the research value shows.

The other big includes US Franklin Templeton feeder funds (RS 3,919 Crore), Motilal Oswal MF’s Nasdaq 100 FOF (RS 3,631 Crore) and Motilal Oswal S & P 500 Index Fund (RS 2,058 Crore).

In recent months, Mirae MF, IDFC MF, MF box, Axis MF, BNP Paribas MF, SBI MF and HSBC MF launched international funds.

At present, HDFC MF is set to launch a world index developed by FOF – special international funds that are dedicated.

As the name suggests, these funds will invest in stocks in countries such as US, Canada, Europe, Japan, Australia & New Zealand, Singapore and Hong Kong, brochures from home funds show.

These markets have a very low correlation with India and, because it is diversified in some geography, it will have low volatility.

Benchmark funds are MSCI World Index.