Nagpur: In an important decision, the Nagpur of the Bombing Bomb of the High Court states that the Department’s Income Tax (IT) cannot issue a new notification to raise fresh claims for corporate debtors after the resolution plan is approved by professional resolution (IDR) under the bankruptcy and bankruptcy code (IBC) .

Industrial circles say it is a big help for all manufacturing losses of companies under the current IBC process.

While the quashing is a notice issued by the Petitioner of Murli Industries Limited, HC answers an important legal point firmly saying “no” whether the IT department can issue a notification to corporate debtors, asking to submit back for the year of assessment before the approval of this resolution plan is below the IBC The land that officers who assess believed in income fees have passed the assessment.

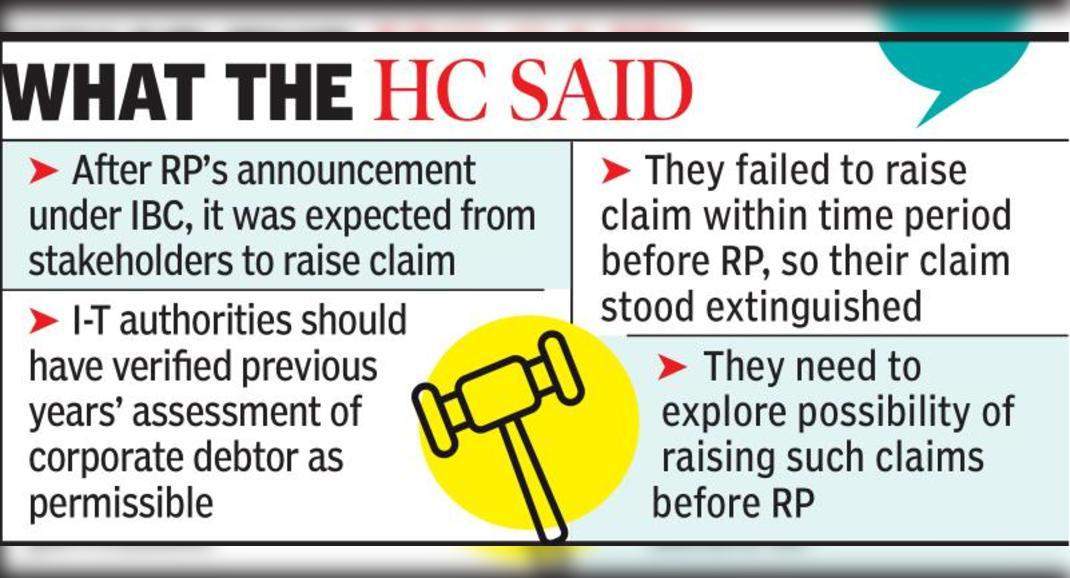

A division bench consisting of Sunil Shukre Judge and Anil Pansare made it clear that after the public announcement was made under the IBC by Rp.

“The I-T authorities must be diligent to verify the rating of previous years from debtors according to the law and to increase claims in the time before Rp.

In this case, the authorities failed to do it and, therefore, claims to stand out, “said the bench.

The applicant has submitted back for the year 2014-15 on September 9, 2014, stating a loss of more than RS28 Crore.

The case under investigated by the I-T authorities and order was passed on December 27, 2016.

Meanwhile, Edelweiss the company’s reconstruction assets submitted an application under the IBC to begin the bankruptcy resolution company process against Murli Industries.

This admitted in the National Court UUPT (NCLT), which appointed Rp.

Interim.

An announcement was made calling for creditors to submit evidence of their claim.

In response, the I-T authorities submitted a claim RS50.23 Lakh.

After that, another company submitted a plan for resolution on December 28, 2017, and was approved by NCLT on June 3, 2019.

The NCLT command was enforced by the laws of the National Companies Comparative Court, New Delhi, on January 24, 2020, and made effectively August 25, 2020.

It considered the officers issued a notification to the applicant on March 25, 2021, trying to reopen 2014-15 assessment, which was challenged in HC.

The company argues that after the resolution plan is approved by the prosecution authority, the notification cannot be removed.

The bench noted that there might be a contingency where sculpture claims were raised after the approval of the resolution plan, because the acceptance of corporate debtors had been suppressed by certain facts while submitting a return from previous years.

“To deal with such a situation, the authorities must explore the possibility of raising these claims before trying the authority by asking to make certain provisions for the payment of legal claims in the plan.

In the absence of claims that have been created and the provisions to complete them, it cannot be raised later.

In this case, the applicant is true in competing notifications that cannot be issued, “HC said.

What HC said * After the announcement of IDR To do this, because of that, their claims stand out * they need to explore the possibility of raising the claim before Rp.

* The applicant is correct in competing notice that is not possible