Nagpur: Fixing responsibility on banks if fraudulent transactions online, Gondia district consumer disputes directed the State Bank of India (SBI) to restore RS18,71 Lakh to two senior citizens who lost the number after being tricked by a swindler on the pretext of a rule Know Your Customer (KYC).

Of the total amount will be refunded, RS18.36 lakh to be paid with interest rate of 6% since Nov.

22, 2019 when the complaint was filed.

Banking behemoth further told to pay Rs25.000 against mental anguish and suffering caused by an elderly couple and RS10.000 towards legal costs.

While most allow the complaint of Dr.

Suresh (65) and Minakshi Katre (61) submitted by Counsels Mahendra Limaye and Maya, Gupta, a bench consisting of the President Yogesh Khatri and Members Sarita Raipure requested the SBI to conduct an internal investigation and recover the amount from the salaries of officers concerned “who do deleliiksi duty and causing harm to a public bank”.

Forum said that it is important to recover the amount as it is of public servants “who have done their duty and causing harassment and mental anguish to the complainant”.

Showed that only after completing all formalities verification of Aadhaar, pan card details, ID and proof of a valid address, the account is opened, the judges said the bank has a network and can easily help customers where they lose the amount of online tricksters.

“If fraudulent transactions occur online, the numbers are still in the system until the time of employment.

Banks can easily stop payments to protect the interests of customers.

Anyone who has stepped fraudulently number of bank accounts can be easily identified,” observed the forum.

Observing that the details of fraudsters can be tracked, the bench said the bank, however, did not help the poor customers and even employees share their details with fraudsters.

“Detail someone just by the bank, then why no one knew that he had an account in a particular branch? It is a burden on the part of the bank and its employees to relinquish his duties first, then only the claimant can be held liable for any alleged negligence,” said the forum , Citing various provisions of the Consumer Protection Act, the forum says that once a complaint made by citing specific incidents of unauthorized withdrawals, it is the duty of banks to carry out the necessary verification, rather than washing their hands.

“Viewed from any angle, SBI failed failed to shake off the burden.

Obviously, there is a shortage of services for its part,” observed the forum.

Limaye told TOI that the judgment establishes that even if the police have not been fully investigated cases of cyber crime, the victims can fight for their rights in cyberspace through the consumer court and can get back the missing amount.

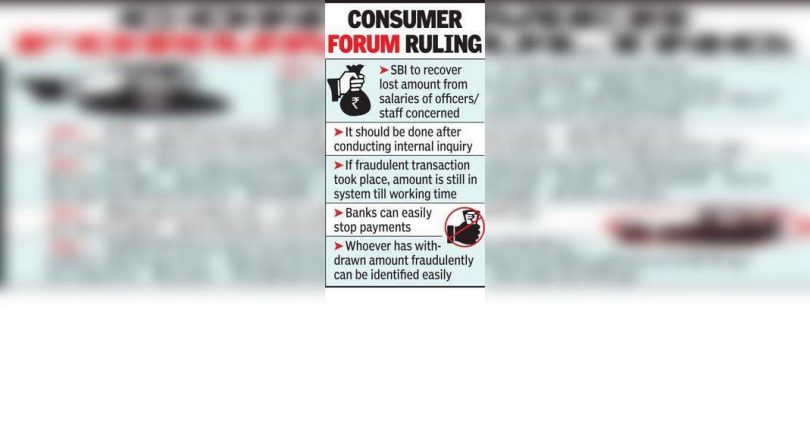

Forum what the * SBI to recover the missing amount from the salary of officers / staff concerned * it should be made after conducting an internal investigation * If fraudulent transactions occur, the amount is still in the system until the working time * Bank can easily stop paying to protect customers Flowers better * Anyone who has fraudulently withdrawn amount can be identified easily * Bank does not help customers and employees to share their details with fraudsters