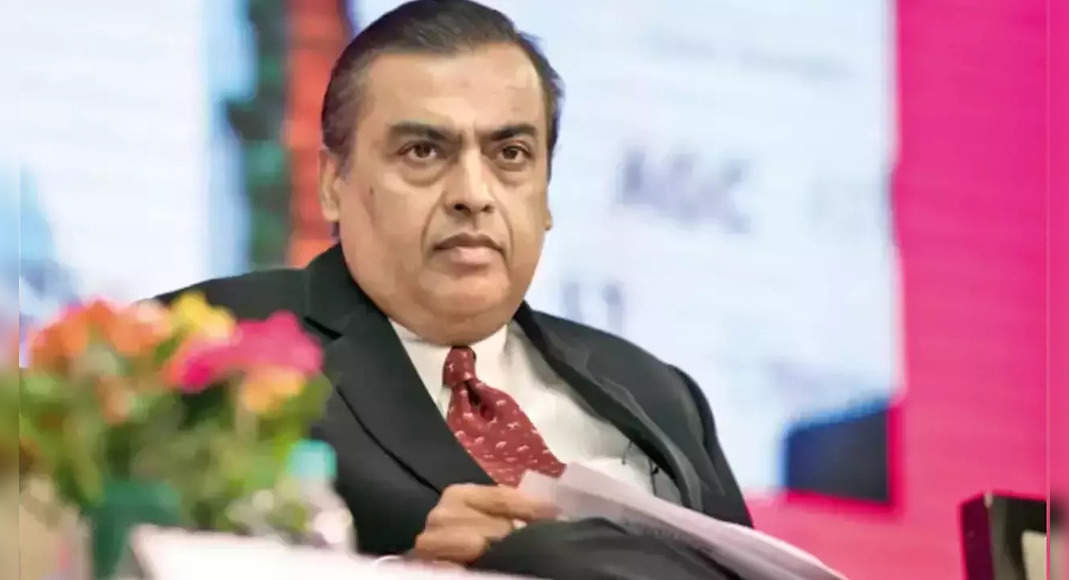

Gandhinagar: Reliance Industries Limited (RIL) has submitted a revised resolution plan to the Tribunal National Law (NCLT), Ahmedabad, to obtain Debt-Ridden Sintex Industries Ltd.

for an offer of Rs 2,700 Crore to Rs 2,800 Crore to Financial Creditors, the source said to be aware of its development .

RIL Mukesh Ambani-LED has reportedly entered the partnership with Care & Reconstruction Enterprise (Acre) assets for efforts to acquire Sotlec.

RIL offers include payments for financial creditors and Equity infusion for working capital requirements, said source.

In submitting BSE on Wednesday, Sintex Industries said the professional resolution was temporarily received a revised resolution plan of the four prospective settlement applicants.

Sintex Industries, which are promoted by Amit Patel and family, specializes in the premium fashion industry.

It provides fabrics for global clients such as Armani, Hugo Boss, Diesel and Burberry.

Other bidders include the Textile EasyGo Group Welsgo, GHCL, and Himatsingkana Ventures, according to sources.

“Revision of the Resolution Plan received from the four Pras must be evaluated by a temporary resolution professional and will then be placed before the creditorship committee, for further consideration,” Sintex said in the submission of his stock exchange.

The Choice of the Swiss Challenge Auction or Inter-SE Offer is considered by a recent lender, said the source.

Sintex was founded in the 1930s as Bharat Vijay Mills, a composite textile factory in Kalol, Gujarat.

Lenders to Sintex got 16 Eois Sintex then changed his name as Sintex Industries.

It deals with textiles and threads, and presence in all Asian markets, Europe, the US and Africa.

In 2017, Sintex underestimated his plastic business into the Sintex Plastics technology to focus on the business thread.

In April 2021, NCLT, Ahmedabad admitted the Petitioner of the Bankruptcy Process submitted by Investco Asset Management (India).

Previously, lenders to Sintex Industries have received 16 expressions (EOIS), including offers from foreign fund investors and the company’s Birla Birla Asset Reconstruction Company supported by capital.