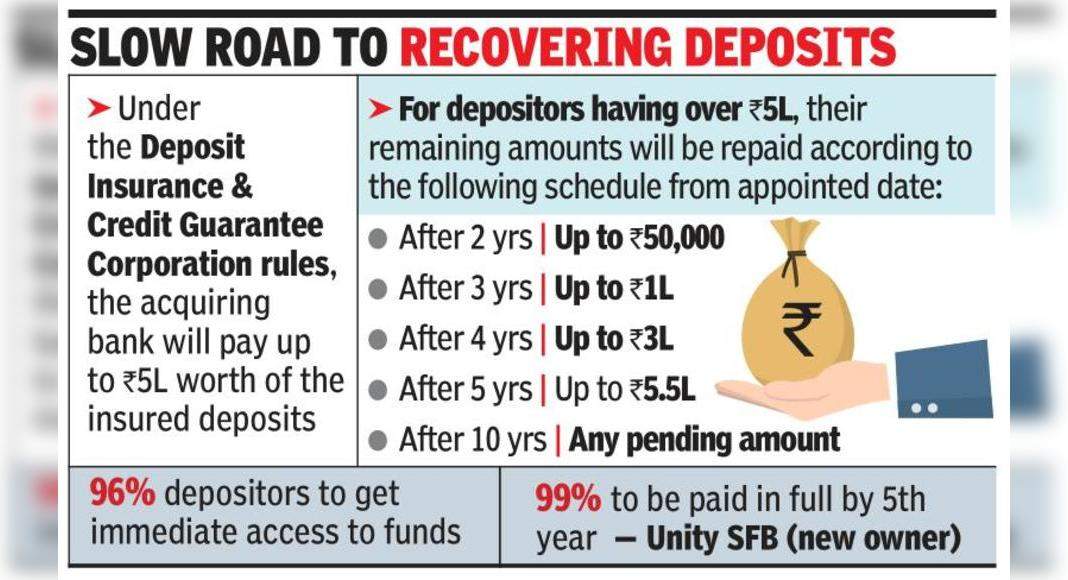

Mumbai: Retail Doset with more than RS 15 Lakh at Punjab Cooperative Bank and Maharashtra (PMC) must wait for 10 years to get all their money back.

The timeline in terms of resolution plans compiled by the RBI, which involves the combination of cooperative lenders that are not functioning with the newly formed Unity Finance Finance Bank (SFB).

PMC Bank resolution through private investment using the SFB license route is the first time the outgoing option has been adopted for stakeholders in a failed bank.

Institutional savers, including cooperative housing communities and cooperative credit communities who have deposits at the bank, will end up trim.

Resolution plans to imagine 80% of their funds are converted into timeless non-cumulative preference shares with dividends only 1% per year.

After 10 years, banks can decide whether to increase dividends or pay investors.

The remaining 20% of institutional funds will be converted to SFB unity equity warrants on Re 1 per warrate.

This warrants will be converted into shares every time Unity SFB floats public problems.

For retail investors, interest at a rate of 2.75% will be paid on extraordinary deposits after five years from the date of notification of the scheme.

The draft proposal will be completed and implemented through government notifications after considering suggestions and objections until December 10, 2021.

Going by experience, major changes cannot be under the scheme because there is a large gap between assets and liabilities.

Banks because of large-scale fraud and no other bidders to take over business.

“Given the financial condition of the PMC Bank, and in the absence of a capital infusion proposal, the bank is not feasible.

In the event, the only action can be a cancellation of the license and take it for liquidation, where depositors will receive payments to the Insurance Ceiling RS 5 Lakh, “Rbi said.

Unity SFB, which has been promoted by Centrum and Bharat PE, said that 96% of all depositors will soon get access to deposits and 99% will be fully paid in the 5th year.

This adds that this scheme saves banks from liquidation and protects stakeholder interests.

“The design of the scheme provides assistance and clarity that is needed for more than 1,100 PMC bank employees, which will continue to work and continue services that are not interrupted to the client,” said the statement.

It added that the bank was operated in a short time after RBI approval on October 12, 2021.

“Our shareholders have made more capital than Rs 3,000 Crore through cash and warrants to be used to build a strong foundation for the bank,” SFB said.