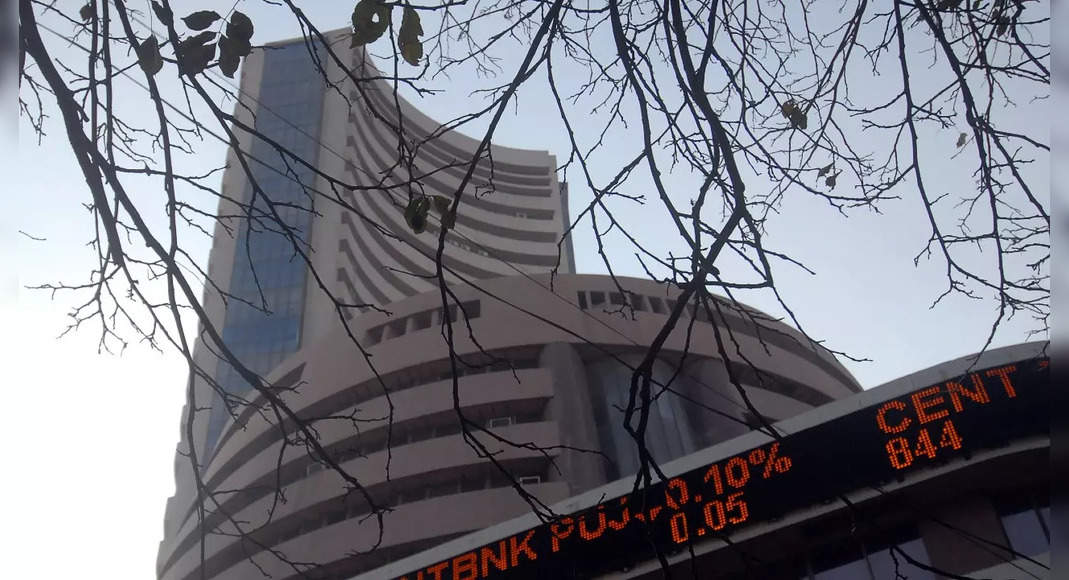

Mumbai: Siles in Sensex continued for the second consecutive session on Wednesday because the results of US government bonds rose while the price of crude oil was close to the $ 90 per-barrel sign, both high-level multi-year.

After a decrease in 656 points on Wednesday, Sensex had lost a total of 1.210 in two sessions to settle at 60,099 with IT stocks watching strong sales.

Selling selling in the domestic market reacts to slides in the global market, analysts said.

It also requires great casualties in several newly registered shares, some of them claimed low-level levels.

Among Sensex shares, the day session saw Infosys, ICICI Bank, HDFC and TCS lead slides, when buying in SBI and Maruti moved away on most.

Sellloff is led by foreign funds that recorded the Netflow RS 2,705 Crore, while domestic funds are clean sellers at RS 195 Crore, BSE data shows.

Wednesday sales also left poorer investors around Rs 1.4 lakh crore, with the capitalization of the BSE market now at Rs 277.8 Lakh Crore.

The global market continues to look for selling because the results of the US Treasury surged up close to two-year highs, according to the Head of the Financial Services Oswal Motilal (Retail Research) Siddhartha Khemka.

“Investor sentiment was weighed by the possibility of more stringent monetary policy to curb inflation throughout the world,” Khemka said.

Market players feel that the increase in US benchmarks will put pressure on the Federal Reserve to raise interest rates – steps that will increase the cost of funds.

This can encourage foreign funds to look unprofitable in developing market stocks, including India.

In the US, after opening a higher marginally and leading index entered the negative territory.

In particular, Nasdaq fell 0.6% in mid-session, which took it to the technical corrective zone because the index fell more than 10% of the peak of all time of November.

In Dalal Street, among the newly registered stocks, One97 Communications (Paytm) broke below the RS 1,000 sign for the first time on Wednesday and closed at Rs 997 in BSE.