New Delhi: Union Cabinet on Wednesday approved the Deposit Insurance Amendment and Credit Guarantee Law (DICGC).

This step implies that bank depositors will now get insurance Rs 5 lakh on deposits within 90 days of bank failure or moratorium.

“Each deposit bank depositors are insured until the RS 5 Lakh in each bank (for the principal & interest).

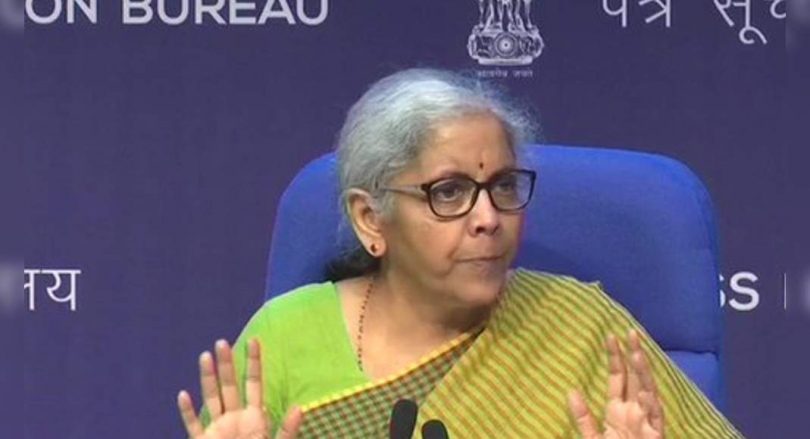

Increased amount insured from Rs 1 Lakh to RS 5 Lakh will cover 98.3 percent of all deposit accounts and 50.9 percent deposit value, “The Nirmala Union Finance Minister Sitharaman announced in the cabinet briefing.

DICG ACT ensures all bank deposits and includes all commercial banks, even foreign bank branches in India, Sitharaman said.

DICC is a subsidiary which is fully owned by the Bank of India (RBI) reserves.

Last year, the government raised insurance protection at a five-fold deposit to RS 5 Lakh to provide support to sick lenders such as Punjab and Bank Maharashtra Co-operative (PMC).

Following the collapse of Bank PMC, yes Bank and Lakshmi Vilas also received stress, which led to restructuring by regulators and the government.

Sitharaman said that the bill was expected to be introduced to the current Monsun session.

After being applied to law, it will provide immediate assistance to thousands of depositors, who have their money parked on lenders emphasized and other small cooperative banks.

The government also cleanses amendments to Limited Liability Partnership Act (LLP), with the aim of decreasing various provisions based on law and fostering the ease of doing business in the country.

The Minister of Finance stated that the center was in the process of “doing many changes in the company’s actions and corporate bodies to get a lot of convenience to do business.” LLPS (limited liability partnership) becomes popular among startups, he added.

“We are expanding small LLPS scope.

LLPS with a contribution of less than or equal to Rs 25 Lakh and a turnover of less than Rs 40 Lakh is treated as small LLPS.

Now, Rs 25 Lakh will go to RS 5 Crore and size turnover will be treated as Rs 50 Crore, “said Sitharaman further.

(With input from agency)