Mumbai: With the definition of a promoter who undergo changes as a large number of private equities and companies led by venture funds are increasingly listed on the exchange, Sebi has decided to eliminate this traditional concept.

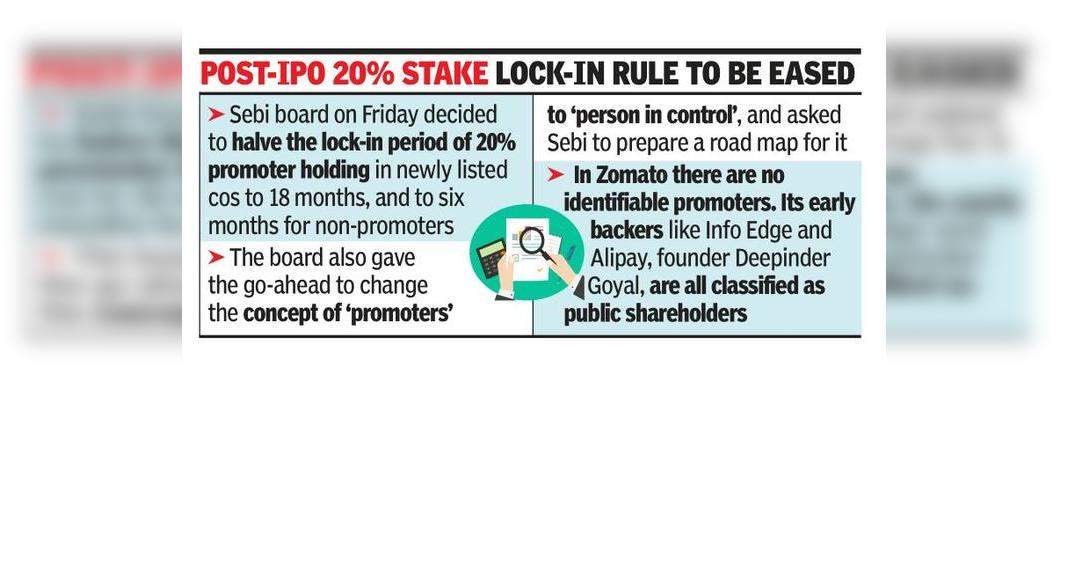

The sebi board on Friday gives its nod to start the process of changing the concept of ‘promoter’ to ‘control shareholders’ or ‘control shareholders’ and request regulators to prepare a road map with their colleagues.

“In recent years, the number of businesses and new era companies with diverse shareholders and professional management who come to the space listed are non-families owned and / or do not have a promoter group that can be clearly identified,” SBI said.

For example, in Zomato newly registered, no promoters can be identified, NSE data shows.

Early supporters such as Edge Info and Alipay (Alibaba Chinese arms), faltering founders, founders and Uber BV, which sells the food delivery business until recently, all registered as public shareholders.

Traditionally, most bluechips such as the reliance industry, TCS, HDFC banks and several others have promoters.

Exceptions include HDFC, ICICI Bank, ITC and L & T.

The council also decided to divide two 20% locking from promoter holding in newly registered companies up to 18 months from three years and for non-promoters for six months from one year.

This will submit to several conditions related to the use of funds raised through the IPO, Sebi said.

Industry experts say the two decisions must maintain market regulations in harmony with the share ownership scenario that appears in this country.

According to Sandeep Parekh, a securities lawyer and former executive director with SBI, the promoter concept is rigid with “almost no international parallel”.

“The decision of the SBI to move to the concept of ‘people in control’ is a more realistic portrayal, liquid and accurate of who truly controls the company,” Parekh said.

Securities lawyers also felt that the reduction in ownership locking was a forward-looking step.

“Private equity investors will welcome the reduction of the post-IPO key period because they can get a way out on time,” Anand Lakra said, partner, said Associates J.

According to Parekh, this decision also has the potential to increase liquidity in the market, “because more shares are available for trading “.

Lakra also feels that Sebi can use this opportunity – steps to change from promoters to control people – to reconsider the control definition itself.

To facilitate the government’s purpose ‘ease of doing business’, SEBI on Friday also canceled the requirement to express post-facto nod for acquisition between 2-5% share ownership in the market infrastructure institution.

“Shares, clearing companies and deposits will place the right mechanism to ensure compliance with appropriate and appropriate criteria,” said Sebi.

Sebi also combines two rules of sweat equity regulations, and distributed regulations of employment-based rewards – becoming a new one named Sebi (Employee Benefits based and Sweat Justice), 2021.