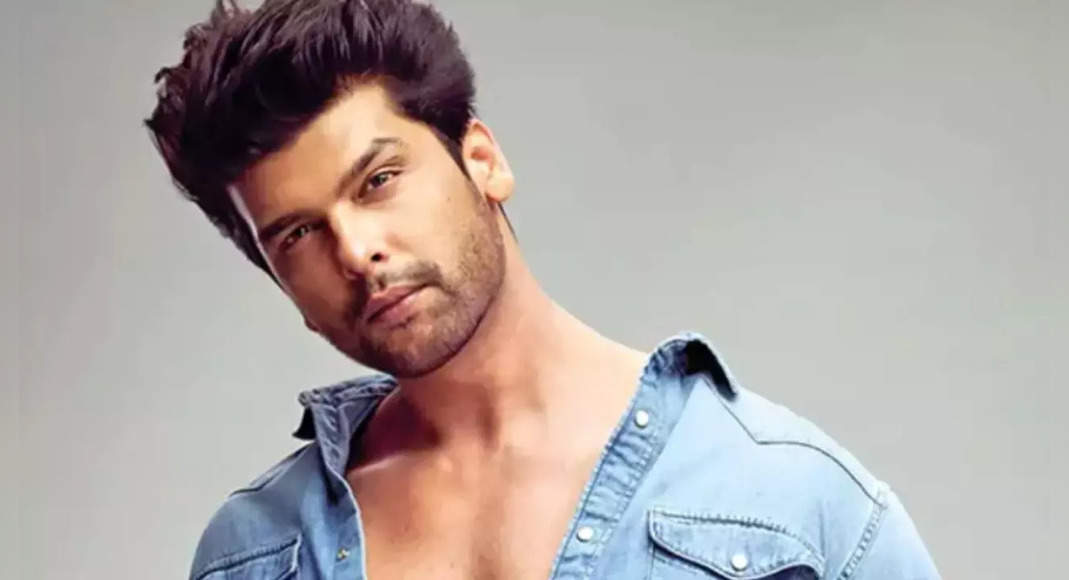

Mumbai: The Mumbai bench from the Income Tax Appellate Tribunal (ITAT) has argued that RS 30 Lakh’s prize was received by Bollywood actor Kushal Tandon from his father not fake and could not be treated as unexplained income.

This is one of the disputed tax problems for the 2013-14 financial year where the actor appealed with itat.

If the court enforces the prize as an incomprehensible income (technically known as ‘unexplained cash credits’), the actor will have to pay taxes at a steep level of 83.25%.

Prizes received from certain relatives (such as parents) are exempt from income tax (I-T) under Section 56 of Act I-T.

However, tax officers tend to check gifts through microscopic lenses to ensure that there is no violation game involved and countless money is not displayed as a gift.

If the recipient cannot prove the prize, it is treated as ‘Cash Credit which is not explained’, which is subject to a tax with a high level of 60% plus an additional cost of 25% and also a 6% penalty.

The final tax rate is 83.25% around.

In this case, Tandon is asked to provide documentary evidence to support prize transactions.

I -T his father returned for the year where the prize was made shows income only Rs 4,12 lakh.

On this basis, I-T officers hold this gift to become a ‘unexplained cash credit’ and try to impose taxes that match the hands of the actor.

Tellon was handed over to itat that the actor’s income which was then limited was not enough to help him fulfill his expenses.

Thus, his father came to save the only son and talented this amount from his past savings.

His father, Virendra Tandon, is a regular I-T payer and has revealed prize transactions in his financial statements.

The act of prize has also been submitted to the Tax Authority.

However, itat shows that the I-T department has failed to know that the Father has discussed the amount of accumulation of his past savings.

In its order, it was said, “We agree with the view taken by IT officers that the income shown in the return of Virendra Tandon’s tax is not substantial.

However, the material facts that have been lost by the lower tax authority are that the actor’s father never stated that he was has given the amount referred to from his income for the year that is considered, but has provisions that strictly stated that the same thing was given to him from the accumulation of his past savings.

“The IT department failed to verify whether the accumulation of savings was produced for years from its income where income tax had been paid or comes from any secret accumulation fund.

Instead, I-T officers rushed through the assessment, adding itat orders.

Based on the overall fact presented, the bench, consisting of members of Rifaur Rahman accountant and members of Judicial Ravish Sood, said the addition of Rs 30 lakh as cash credits that cannot be explained without reward.