Mumbai: The decision by the US Federal Reserve on Wednesday night to start tapering its quantitative easing program (QE) of $ 15 billion per month from November itself and the Indian government’s decision to cut customs in Petro products on Thursday.

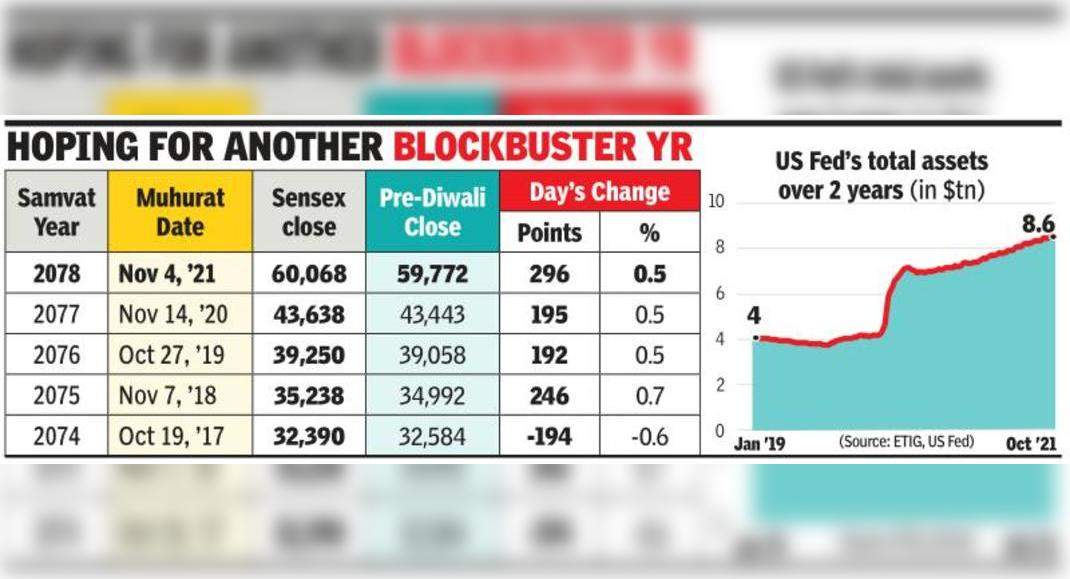

The BSE index rose 296 points to end 60,068 during the Muhatat session for Diwali.

HDFC Bank, Reliance Industries and ITC led the enhancer during a special night session that delivered the Samvat 2078 year, while Icici Bank witnessed several profits.

Veteran at Dalal Street said that on the first day of Samvat, during a special trading session for one hour, someone could only buy shares, even if it was small, and should not sell.

During the Muhatat trading session on Thursday also, after one year of high increase when Sensex rose 38%, a positive mood was seen at the BSE International Convention Hall in the city.

The mood was assisted by post-market decisions of the government on Wednesday to reduce gasoline and diesel prices sharply, a step expected to partially overcome inflation fears in this country.

The government’s decision came after the price of two important Petro products increased several times in recent months and was at the record level, mainly due to the increase in crude oil prices globally.

This step is expected to directly have a calming effect on inflation and indirect effects through reducing transportation costs.

According to the Head of Barclays Chief India Rahul Bajoria, the impact of inflation from this decision will be limited to consumer price inflation (CPI), but can reduce logistics costs in matter.

“The price of fuel has climbed over the past three months, with diesel prices and gasoline rose more than 20% year-on-year, achieving historical highest in the provisions of the level,” reports by barclays noted.

“The impact of this tax reduction will be limited to inflation, because diesel has a very small weight (0.15% in the CPI), but reduction of gasoline (2.2%) tax will contribute materially.

Overall, the direct impact of this price reduction will be 12 basis points (100bps = 1 percentage point) on the headline CPI in November, and will lead to indirect impacts of 12bps reduction in three months, bring a total impact on 24bps.

Bajoria wrote.

In addition, Wednesday night late, after months speculation when it is possible to attract plugs on the $ 120 billion bond purchase program per month, the US Fed – the largest economic central bank in the world – finally said it will start it this month.

The purchase limit per month which is reduced is $ 105 billion .

As uncertainty about the time and the amount of tapering ended, the Dow Jones index rose more than 100 points on Wednesday night.

Rally in Tech and Chipmakers continued on the day Amazing too, which helps the S & P 500 and the Nasdaq Composite for recording the highest.

The end of uncertainty is also expected to leave traders in Dalal Street to focus on other problems, said market players here.

After a great year for equity, investors look forward to the stock market continued to rise, although not at the same speed as last year, said HDFC Securities MD & CEO Dhiraj Relli.

“Global Headwinds Increasing Inflation and Withdrawal of Monetary Stimulus can have an impact on momentum, but the strength in Indian macro and enhancing Micros can help compensate for this.

Investors need to do portfolio reviews and asset allocations, and improve the quality of shares held in their portfolios,” said Reli.