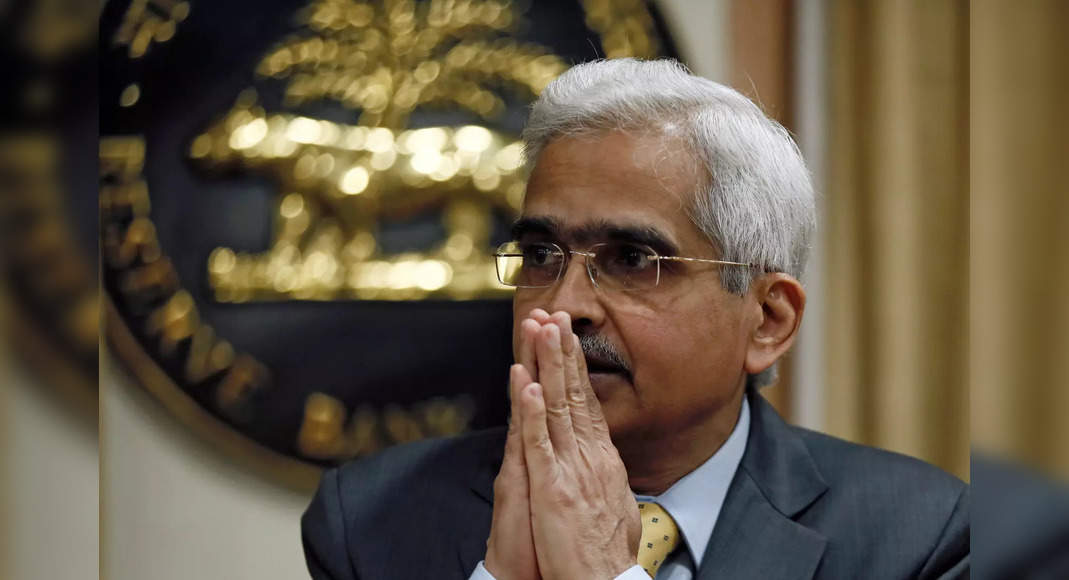

Mumbai: Governor of RBI Shaktikanta Das on Tuesday met the head of the Bank’s head and asked them to remain vigilant about signs of vulnerabilities that appeared and took timely improvement measures to reduce risk.

Even when the watershed recognizes the resilience of the banking sector, the central bank seeks to increase pre-emptive actions against weak banks by reworking the corrective action norms (PCA) that are rapid to enable surveillance interventions at the right time and the use of loan restrictions as a tool for discipline market.

Careful notes come at the time when there is an increase in optimism in connection with the economy even when stress related to pandemics continues to be felt in several sectors.

The bankers have begun to talk about recovery even when some countries in the world experience the third phase of locking.

Das on Monday held a separate meeting with the MDS and CEO of public sector banks and several private banks through video conferencing.

He suggested a bank to take time on time to reduce risk and maintain stability not only the institution itself but also from the entire financial system.

Some other things, including credit flows, especially for micro and small businesses, are also discussed during meetings.

Das seek feedback from the Chief of Tribe on the prospects for assets and steps emphasized for mitigation, risk prices and the efficiency of the collection experienced by the bank.

He also asked the bank about their involvement with the Fintech entity.

This is the first meeting with the bank after the DAS was given a new three-year period by the government last week.

The meeting was attended by the Deputy Governor of RBI M K Jain, M Rajeshwar Rao and T rabbi Sankar.

New norms for PCA come after most of the weak banks have come out of loan restrictions imposed by the central bank under the previous framework for early corrective action.

The number of records 11 banks is placed below the PCA after the bank sees a bad loan surge after the review of the quality of the RBI asset in 2016.

“The PCA frame does not prevent the RBBI from taking other actions as it is considered to be suitable at any time, besides that for corrective actions prescribed in the framework , “RBI said.

Bankers said that in the past the bank was placed under the PCA based on their audited financial results and now indications is that the RBI might impose restrictions if they are required based on its supervision.

On Tuesday, Deputy Governor of RBI Jain said that the central bank also focused on governance reform.

He said that banks need to put governance standards to be feasible for public trust.

“Being an entity that is highly used and with the connection, there must be separation between ownership and management, so that they operate on professional paths,” he said.