Mumbai: Default by several ESEL group companies still affects mutual funds more than two years later.

Market Regulator Sebi on Friday sentenced Mutual Fund boxes because of its delay in making full payments to several investors in mid-2019.

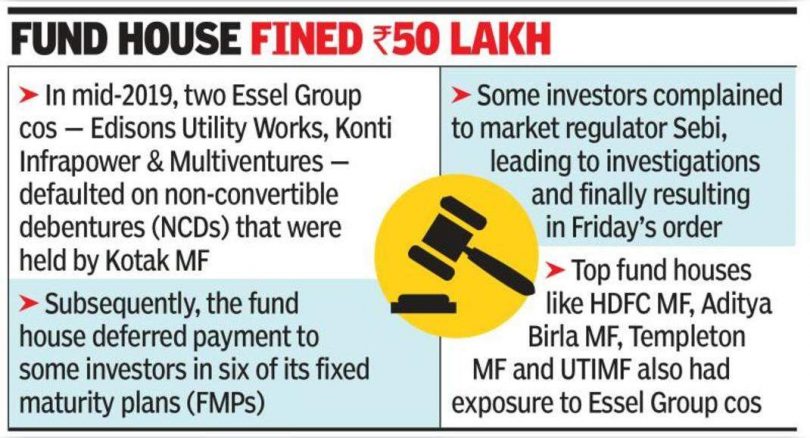

Delays occurred because of two Essel Group companies – Edisons Utility Works and Konti Infrapower & Multiventures – have default on Non-Convertible Debentures (NCDs) which was held by six fixed maturity plans (FMF) box MF.

Barred barred MF box from launching a new FMP for six months and asked him to pay a fine of Rs 50 Lakh.

Furthermore, he ordered home funds for part of a refund related to fund management and advisors for investors in the six FMPs.

In this FMP, the full amount was not returned to its investors after two Essel Group companies failed to return money for the MF box scheme for 2019.

A spokesman for home funds, who reacted to all investors paid in full along with the interest in September 2019.

MF “is committed to protecting investor interest at any time”, spokesman added.

This case is related to the NOL-Coupon NCD Fund holding of two Essel Group companies in six FMP where the default company in April-May 2019.

Although NCD was supported by entertainment shares with houses, the stock price then fell dramatically.

Therefore, the house house did not sell the shares to recover a portion of his loan to the two companies, the sources at MF then told the Toi.

Because five other home houses are also in the same position, holding Zee Ent shares as collateral, every forced sale by the MF box will encourage other home houses to also sell shares, which lead to crashes in the price, the source said it.

At that time, HDFC MF, Aditya Birla MF, Icici Prudential MF, Templeton MF and Utimf were also exposed to the Essel Group Companies.

In the order of 84 pages, Sebi said that there was a deviation in the MF box in conducting a thorough test and in risk assessment when making investment decisions related to this NCD.

Sebi also said that the Fund House failed to disclose information about the negative impact on six FMP to his investors on time.

“Ignoring the thorough test, the late helplessness in communicating with investors, violations of legal sanctity due from the FMP scheme, allowing the extension of NCD maturity from conflicting publishers, etc …

it comes there is no doubt that (home funds) has acted with violations The weight of the provisions is equal …

and various circulars issued by the time from time to time, “the Order said.

On his side, the MF box relied on circular sebi related to the MFS issued on June 20, 2002 which said that the house of funds will do all efforts to recover its full-level investment value for two years after the closing of the scheme.

After Sebi Rules, House Funds have made every effort to recover the full value of NCD.