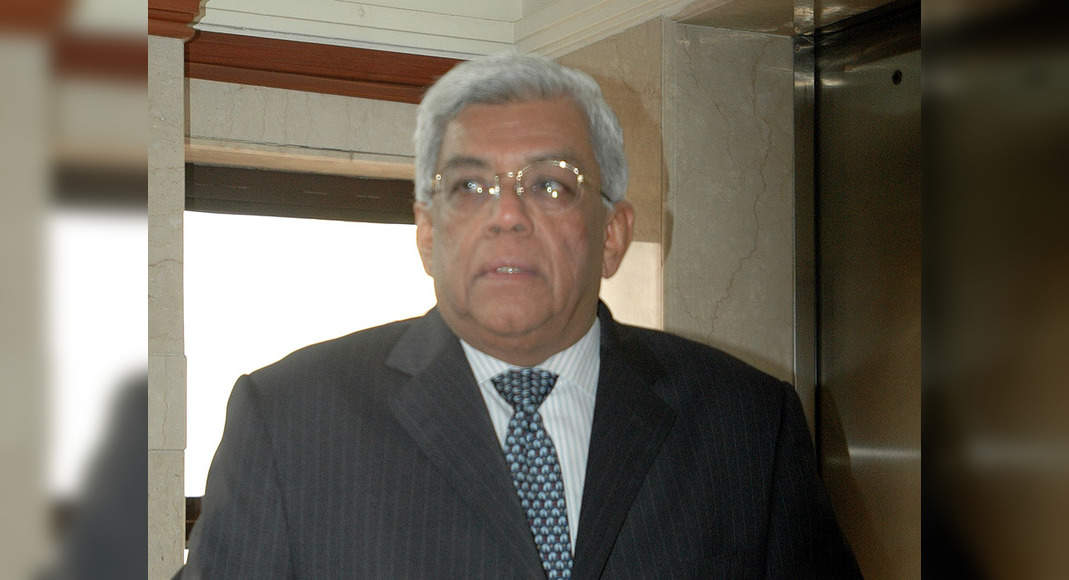

New Delhi: Chairman of HDFC AMC Deepak Parekh on Friday said the Indian Mutual Fund industry has the potential to grow exponentially because the level of MF’s penetration remains low compared to the large economy.

While talking about the economic growth of the country, PAREKH said growth tended to be strong in the FY22 behind the beneficial basic effects, supportive fiscal and monetary policies, and floating global environment.

In addition, PAREKH praised the new framework for harmonizing the interest of the main employees with the Holder of the Mutual Fund scheme but believed more flexibility must be given to staff to choose a series of schemes they want to invest.

The employee must be given flexibility based on their own risk profile within a 20 percent limit set by the regulator, he added.

The regulator has been asked for several modifications to the round, he added.

“Let the main employees decide on their own risk profiles and allocate in their respective schemes.

Also, the regulator has been fair in terms of computing 20 percent of post-fund reduction and mandatory tariff tax.” I want to ask the regulator to also consider mortgage payments as part of cutting.

Mortgage payments tend to be the number of materials, especially for younger employees, “Parekh said at the AMC HDFC General Meeting.

Sebi, in April, asked the asset management company (AMC) to pay at least 20 percent of the gross salary of the main employees in Indonesia Managed by them.

New rules cover all major employees who have been defined as the heads of various functions and all employees involved in the fund management process – fund managers, teams and research dealers, among others.

Overall, industrial assets under management (Aum ) Up 41 percent year-to-year to close at Rs 31.4 lakh crore.

Over the past five years, Aum Industry has seen the annual growth rate of compounds (CAGR) of 20.6.

percent, and equity oriented Aum has increased in CAGR 25 percent.

Despite high growth, PAREKH said the Indian Mutual Fund The AUM-to-PDB ratio remained significantly low at 15 percent compared to with N average global 75 percent.

Similarly, the equity of AUM T o The market hat stands at five percent with a global average of 30 percent.

“Indian penetration rates with any size remain much lower than other major economies.” India has more than 50 permanent account number income tax (pan) but only 2.2 crore mutual fund investors.

It reaffirms my belief that this industry has the potential to grow exponentially, “said Parekh.

He further said that the global agent admired the Framework of Indian Mutual Fund Regulations and considering the industry among the top in terms of global best practices.” I hope we can use it about this and make our domestic mutual funds accessible by international investors, “he added.

On the front of the economy, Parekh said that the second wave of Covid-19 was significantly higher than the first and had an impact on the recovery of medium growth It took place since the last quarter of TA 2020-21.

“Although there are fears of impact on consumer sentiment and whether recovery will be as fast as last year.

I believe that the normalization of PACE will quickly occur when economic activities stabilize, “he added.

Furthermore, most of the population will be vaccinated in India by the end of this year, which is likely to support the rebound, Parekh said.

Moreover, the growth of healthy investment in Q4 FY21 and encouragement The central government to encourage expenditure through a higher budget allocation, increasing access to infrastructure financing, among others, must help resurrection, he added.