New Delhi: Parlementer Panel has expressed concern for the withdrawal or non-implementation of the central flagship scheme on plant insurance as many as seven countries, saying more such examples in the following years will “defeat the goals launched by the scheme”.

Panels, the Committee remained on Agriculture, in his report at Lok Sabha on Tuesday said that even though most countries withdrawal carry out their own schemes, the government must correctly see the reason / factor that leads to withdrawal or not implementing the central scheme.

Punjab has never joined the central scheme, Pradhan Mantri Fasal Bima Yojana (PMFBY), since it was launched five years ago while Bihar and West Bengal have been withdrawn from it in 2018 and 2019.

On the other hand, Andhra Pradesh, Gujarat, Telangana and Jharkhand no Applying a scheme last year.

Countries quote “financial constraints” and “low claims ratios during the normal season” as the main reason for non-implementation schemes.

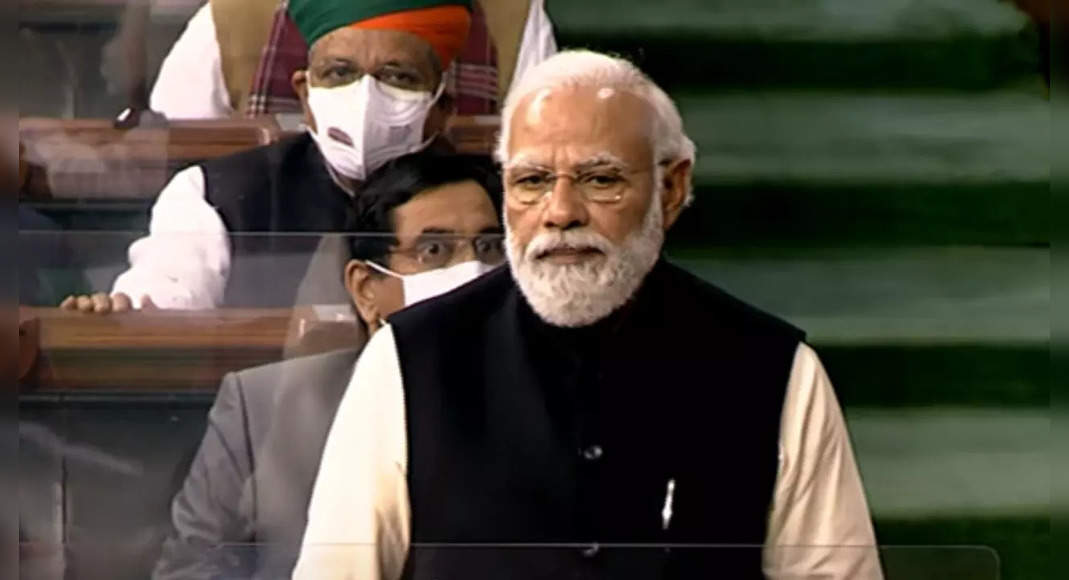

Referring to the reason, the panel, led by a member of BJP Lok Sabha P C Gaddigoudar, asked the ministry to begin the appropriate steps so that they continue to implement schemes and farmers reap the benefits.

PMFby was launched with the effect of April 1, 2016 after playing back the previous scheme to enter more risks under plant insurance cover and make it more affordable for farmers.

This scheme is very well received by farmers in the first year of its implementation.

The coverage is 30% of the Cropped Gross Area (GCA) in 2016-17.

This is the highest coverage in the history of plant insurance in India.

But then, it decreased to 27% in 2018-19 and 25% in 2019-2020.

Note shows that coverage in terms of insured areas under PMFby decreased from 567.2 lakh hectares (HA) in 2016-17 to 508.3 lakh ha in 2017-18 and then 497.5 lakh ha in 2019-20.

The withdrawal of the state of the scheme was quoted by officials as one of the reasons for the decline in the trail of the scheme.

However, there are other reasons.

“The decrease in the coverage of the area under PMFBY is caused by deduplication by making a mandatory aadhar, the announcement of debt neglect schemes by several countries, the integration of land records in the state of Maharashtra and Odisha and non-implementation / suspension of the implementation of schemes by several countries such as Bihar, West Bengal and Andhra Pradesh, “representatives from the Ministry of Agriculture told the committee when asked about the reason for decreasing coverage.

Under PMFBY, a uniform maximum premium is only 2% of the insured amount paid by farmers for all Kharif (summer) plants and 1.5% for all rabbi plants (winter planted).

In terms of commercial and annual horticulture plants, the maximum premium that must be paid by farmers is only 5%.

The premium level that must be paid by farmers is very low and the actuarial premium balance is borne by the government, to be shared equally by the state & central government, to provide a full amount of insured to farmers to the loss of natural plants due to.

The panel in its report evaluates PMFBY is also marked that the delay in the claim of claims has become one of the main barriers of the scheme and asks the Ministry of Agriculture to complete an effective solution to deal with this problem so that farmers do not suffer even though plants insurance cover.

Although the ministry has made a provision of penalties (an interest rate of 12% per year that must be paid by insurance companies to farmers for delays in the completion of claims outside the 10 day deduction date specified for claims payments), so far.

, do not solve the problem of delay in the completion of the claim.

“The farmers use insurance under PMFby in the hope that it will help in mitigation of losses during distress.

But the delay in the resolution of the claim to defeat the purpose of this scheme,” the report said.

Emphasizing that “delays in confreation of claims cannot be accepted in any way”, the panel recommends the ministry to make a scheme more driven by technology and ensure that all institutional mechanisms work together so that the claimability of claims becomes free of interference and farmer-friendly.

.

It also recommends that when the reason for delays is non-payment of subsidies by the state, premiums paid by farmers are returned together with interest in a fixed time frame.