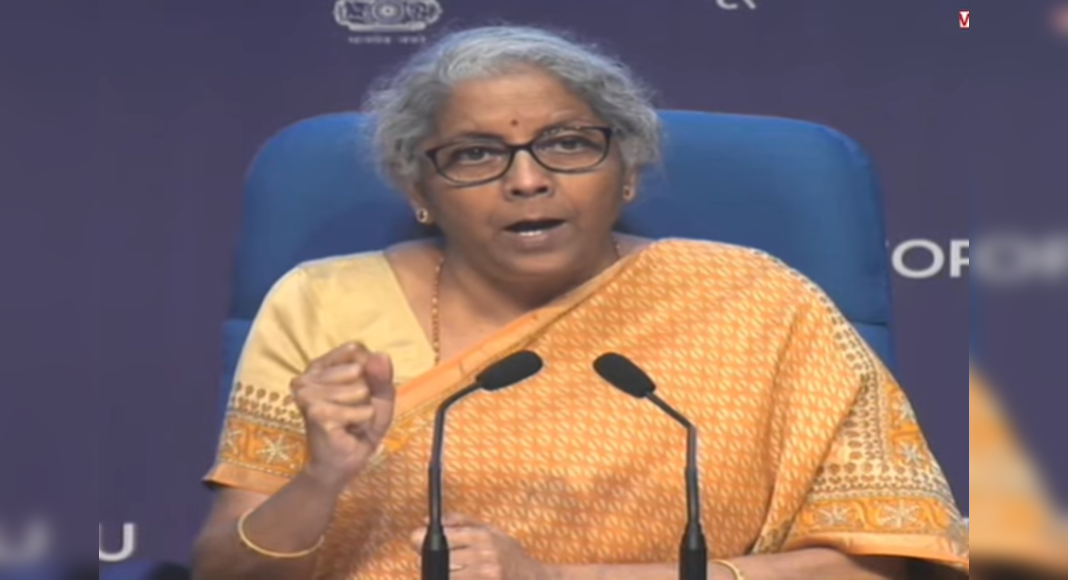

Aurangabad: UNI Finance Minister Nirmala Sitharaman said on Thursday that Trinity ‘Clock’ (Jan Dhan-aadhaar-Mobile) has become a modifier of games for India, allowing them to advance financial inclusion in a futuristic format.

“By bringing financially excluded, saving theft, and channeling government benefits for true beneficiaries, by providing SMS updates to citizens on their bank transactions, congestion exceeded our banking to a different level at all,” he said while handling prime prime The ‘Manthan’ conclave session was detained in Aurangabad.

The Minister of Finance said that Prime Minister Narendra Modi was clear that financial inclusion would likely be better achieved without anyone’s inconvenience, using Trinity Jam.

“Clock Trinity is a modifier of games for a country like India, it’s futuristic and touching the philosophy of SAT KA SATH, SAB KA VIKAS, SAB KA VISHWAS.

The aim is to reach the last man on the track, the most remote corners and people in the area Untouched and far from the mainstream, without discrimination, “he said.

Sitharaman said that the PMJDY account helped the government to reach everyone, even if the account is a zero balance account.

Even people who are hesitant to enter the mainstream are also brought in and given confidence, with the opening of their account, distributing rupay cards, and insurance protection.

He added that the financial inclusion carried by Jan Dhan had been established during a pandemic as a grave as a pandemic Covid-19.

That’s because Jan Dhan that many people and small businesses get collateral loans, he said.

Sitharaman noted that Aadhaar Linkage has saved this country a lot of theft, allowing the government to direct money to true beneficiaries.

“Aadhaar nurseries from a bank account gave us the benefits of instant KYC.

These beneficiaries get direct benefits to Verified Jan Dhan and KYC accounts.” Overcoming the meeting, the Minister of State for Finance Bhagwat Karad highlighted the transformation caused by the Government Financial Inclusion Program.

He also asked the banker to focus on ‘aspirational districts that have not reached the financial inclusion target.

Karad also mentions that decisions will be taken to make mudra loans more troublesome and available for those who want to start a business.

At present, India has a surprising 43.23 Crore beneficiary account under PMJDY.

This center, in recent years, introduced a series of customary platforms to facilitate banking quickly, safe, and evenly distributed.

For example, the application of Bhim Upi is now a classic component of the Indian market.

It also recently launched e-rupi voucher facilities that reduce internet requirements for financial transactions.

Conclary Mantan in Aurangabad aims to continue the purpose of government financial inclusion through technology.