Every sensible investor should have, at least once in a lifetime, ‘stupid moment’ of their own.

My stuff came in February 2000.

After the lucky invest a small amount of money, in some technology stocks, in 1998-1999, I sat down one afternoon in early 2000 and shook my head in disbelief.

MyPortfolio mostly tech stocks trash (TECH, then, is defined as any company with a website) has been increased by about 20 times in two years, makes me a guy mid 30s who is wealthy, blessed with no special skills except being in the trade correct.

Fortunately, I had an inferiority complex about my investing skills, and a portfolio of mine told me: “You are a lucky fool”.

I take my money off the table, pay my taxes, and go on holiday to Spain.

Everything pathological ugly when I came back after a month.

2021 appears to be similar to 2000.

There are millions of ‘lucky people’ on the planet in recent years.

Pandemic get rid of millions of jobs.

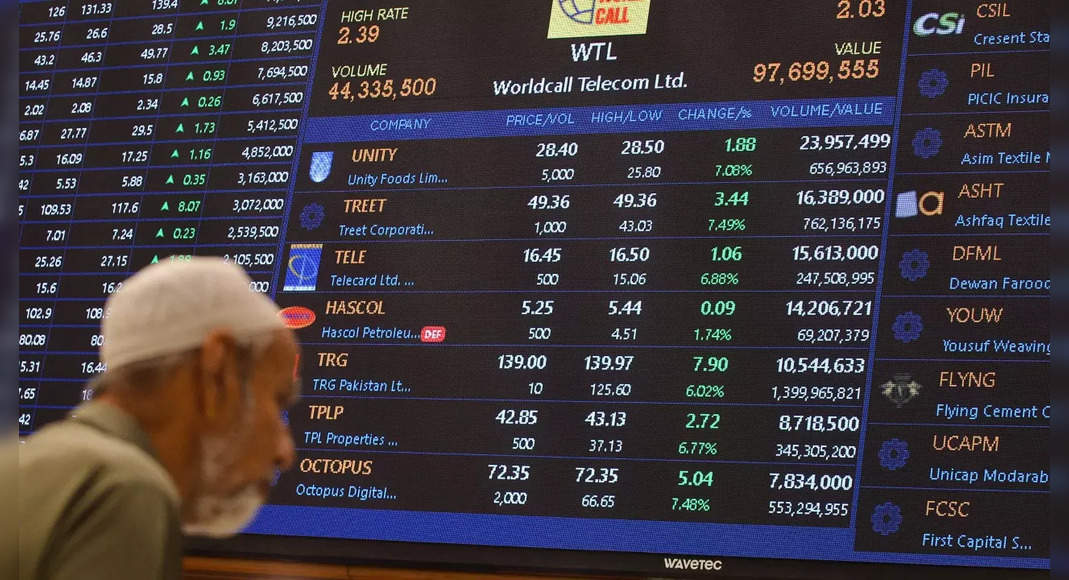

The stock market gives millions of keys to the kingdom, by giving them the job of investment / trade full time.

We have reached 2022, in one piece, but with a planet full of 25-35 year very confident.

Is this going to end well? What most people forget or do not know about the market is that it results in the market are various probabilities.

At that point in time, you can have different probabilities that support any thesis – bullish or bearish.

The probability that we are facing now, in global equities, mostly in the yellow zone.

Maybe there is a piece of green, perhaps a 10-20% chance that the market remains very buoyant in 2022 as well.

Analysis of nearly 100-year period showed that the probability of the market provide substantial positive returns, for the 4th year in a row, is next to zero.

The global market has provided excellent returns in 2019, 2020 and 2021.

Statistically, we set up for the fall in global markets.

Or at least, the year average.

That’s the long-term probability tell us.

Paying for overseeing the probability grouping.

What can cause a decrease in the market? Well, all the classic signs are in front of us.

Take a bubble in the startup.

Companies that do grocery delivery within 8 minutes got a valuation of $ 600 million, in a few weeks.

Now, for the life of me, I do not understand who would want groceries delivered within 8 minutes.

And I can not understand, beyond this, why any business case can be made for companies that make deliveries to 8 minutes.

A fintech (I suspect it is NBFC + application + two of iit) approached me recently for funding.

Ask? The increase of $ 3 million on a valuation of $ 20 million.

Revenue of just under $ 150,000.

And the founders of the data shows that companies with lower incomes is increasingly valued.

IPO market is another red flag.

Retail rushed, buy goods at 50x earnings (PE MandLes is SO 1998).

I believe there is an 80% chance the majority of the new age companies will be reversed.

It is a term that I created the bust Tech 2000, indicating that the stock that combines 50%.

On the way down, that is.

That said, there are already deep bear market and cruel, globally, in the company of a new era.

It’s a small list: platoon, Roku, Fiverr, Jumia, DocuSign, Mercado Libre, Wayfair, Snap, Zalando, Sea, Hero Messages, Hello Fresh and Doordash.

Thank God, Indian TV channels do not show all of this is rated PG.

When the cycle rates unchanged, as it has, for the moment, the stock without the support of the assessment, get them out from under foot pieces.

Last: Each micro cap EV is playing or has a ‘carbon credits’.

If anyone has them, you get a market cap of billions of dollars in 6 months.

Even the jewelry company has a current EV game.

If all this is not a plain nuts, then I am too old for this game.

Although I play the same game with pleasure but cunning, hoping that I was ‘lucky fool’ again, 20 years old.

The writer is co-founder of the first global