Mumbai: The shortage of chips that are ongoing will probably moderate the growth of passenger vehicle sales up to 11-13 percent of this fiscal, down from the estimated volume growth of 16-17 percent, delaying industrial recovery because the waiting period increased in the middle of a strong demand in the middle of a strong demand .

Because of the production sidewalk, said a report.

The lack of semiconductor will cause a decrease in 400-600 basis points in sales from 16-17 percent, it looks earlier to 11-13 percent, according to the analysis of the three top passenger vehicle companies which ordered a combined market share of 71 percent.

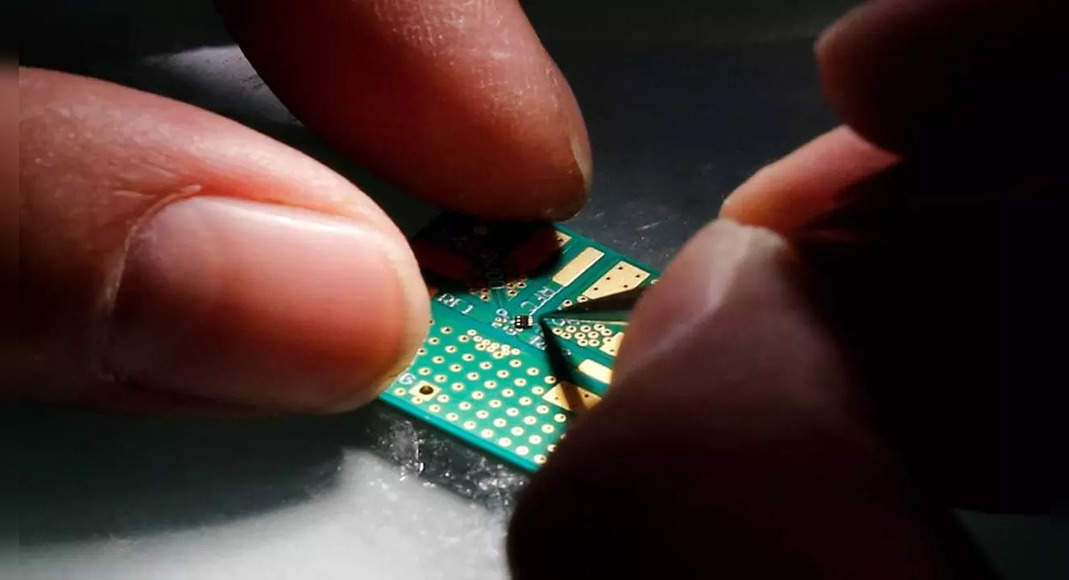

Semiconductors or chips are the main components of the vehicle because they facilitate various features such as navigation, infotainment and traction control and more premiums for using the chip up.

For OEM, the shortcomings have caused production losses, while for customers, the waiting period for several models has increased from 2-3 months to 6-9 months now, the report said.

Uncertainty caused by a pandemic caused a sharp swing in order by car companies that contributed 10-12 percent of global chip requests, the report noted, adding this caused chip makers to divert their inventory to other sectors such as consumer electronics that saw a consumer surge in demand Especially during the pandemic locking months.

The report blamed the lack of poor inventory planning by OEM, stockpiling chips by Chinese companies, and natural disasters regarding major chip factories regardless of logography at the port.

Because the pandemic begins, preferences for personal mobility have increased, leading to car demand more than expected, he said.

In addition, consumers have also chosen vehicles with more features driven by electronics that employ more semiconductors, the report said.

The upsshot of the lack of chip is cut into car production, which will have bearings in the ongoing celebration season and when sales are usually higher, he said.

“As a result, we estimate the overall growth of anger for this fiscal car industry,” the report said, adding shortages is expected to linger in the first quarter of 2022 because the addition of capacity is not in accordance with demand.

It takes at least 12-18 months to establish Greenfield chip facilities.

OEM in their part overcomes the shortcomings by diverting chips to high demand segments such as utility vehicles (51 percent of sales in the fiscal first half increase from 42 percent in the year, from medium segment vehicles), and prioritize premium car production.

Some of them even delete features of a particular model, to save the use of chips, he said.

In addition, the impact on the operation of leverage originating from production losses, higher metal prices can also cause their operating profit of 100-150 bps to 6.5-7 percent of this fiscal, the report said, adding, their credit profile will remain Stable by still healthy cash flows, a strong balance sheet and strong liquidity.