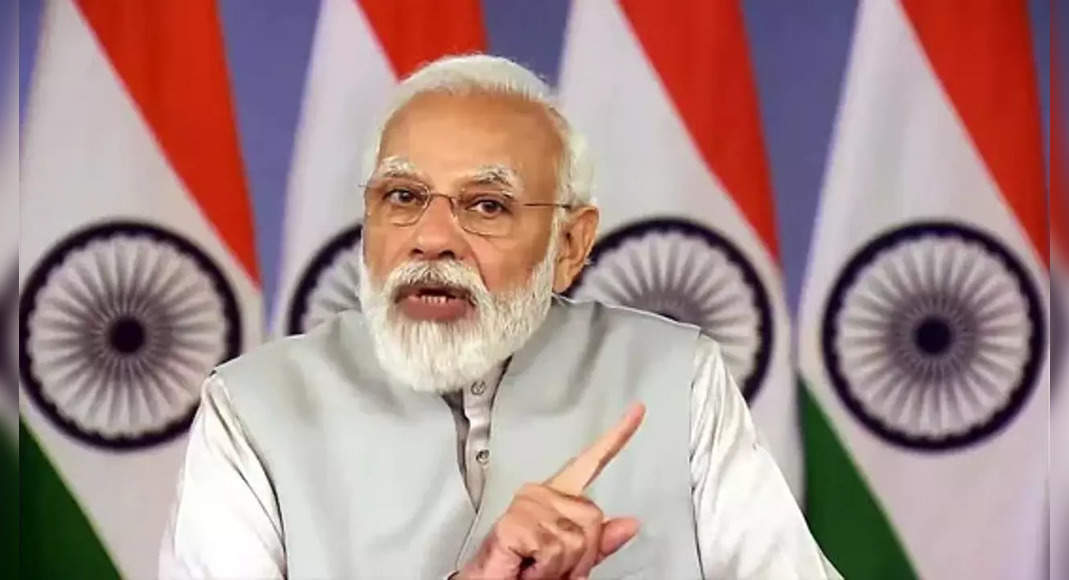

New Delhi: Prime Minister Narendra Modi on Sunday, in a veiled attack on the previous government, that the middle and poor class has been repeatedly disadvantaged by the banking crisis, but India is currently committed to fixing this problem.

Talking in ‘First Depositors: Guaranteed Insurance Payment Deposit Time to RS 5 Lakh Here, the Prime Minister said that the central government led by BJP has increased the financing system and has introduced various reforms in the past 7 years to benefit poor and medium individuals.

He said that in the past few days, more than 1 lakh depositors had earned their money back trapped for years amounting to more than Rs 1300 Crore.

“Over the years, the attitude of tucking the problem under the carpet is common in our country.

The middle and poor class we have time and again suffer from the banking crisis.

But India has only been determined to solve this problem,” said PM Modi.

“Today is an important day for the banking sector and account holder.

Today symbolizes the fact that the government always save ‘depositors first’.

The first depositors, the name of this program reflects their priorities and responsibilities to them and their needs,” he added.

Parliament in August has passed deposit insurance and Credit Guarantee Corporation (Amandment) Bill, 2021, ensuring that account holders reached RS 5 Lakh within 90 days from the RBI forcing a moratorium on the bank.

This was done in the mind of ‘depository first’ in mind, Modi said while announcing that more than 1 lakh depositors were around RS 1,300 crore their money with banks depressed in the last few days with the enactment of the law.

PM Modi assured that around three lakh more accounts will get their deposits with banks under the RBI moratorium immediately.

Overcoming the Prime Minister said the bank played an important role in any nation’s progress.

PM also said that “To take advantage of this opportunity and build a feeling of our depositors, we have increased hats from Rs 1 Lakh to Rs 5 Lakh.” Finance Minister Union Nirmala Sitharaman and Governor of RBI Shaktikanta Das was also present at the event.

Shaktikanta watershed warns depositors to be careful when pursuing high refunds because they come with a higher risk.

“This country has shown working together during this Covid pandemic.

Indian moments have arrived where India can truly become a gross driver of the world economy.

It will be possible if all stakeholders in the banking sector work together,” added the watershed.

Insurance deposits protect all types of deposits in commercial banks, including savings, fixed, current, and repetitive.

Deposits in the state, center, and primary cooperative are also insured, as well as deposits in the state and the territory of the trade union.

With the insurance coverage of RS 5 Lakh deposit per depositors per bank, the number of accounts that are fully protected at the end of the previous financial year constitute 98.1 percent of the total number of accounts, as against international benchmarks 80 percent.

(With input from the agency)