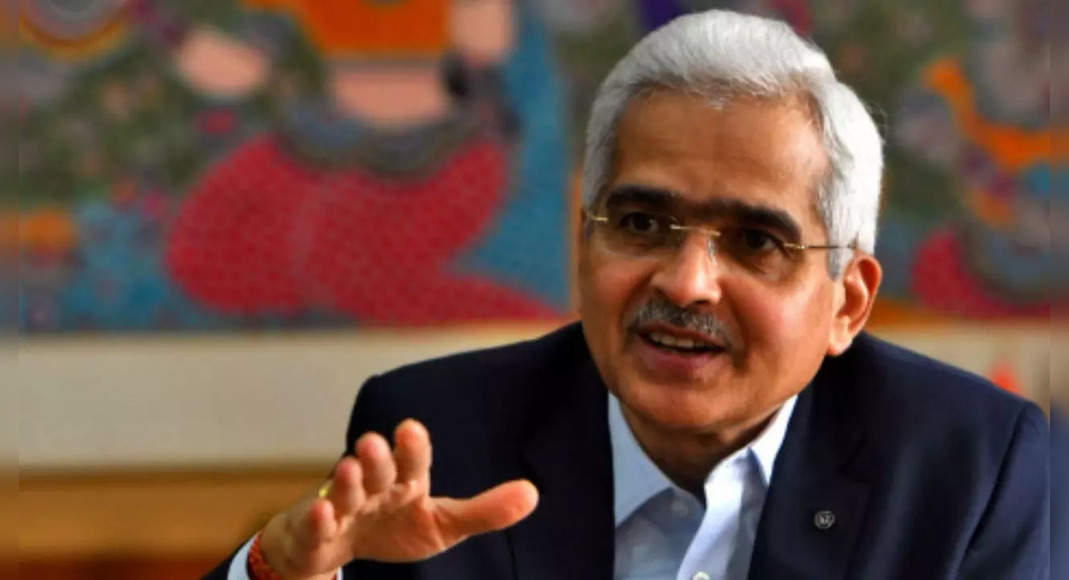

Mumbai: Defending the old pause in a sustainable increase in interest rates and accommodating attitude, the reserves of the Bank of India (RBI) Shaktikanta Das Governor on Thursday said at this time, “monetary and fiscal policy cannot be a good question or, but must enter one tandem same “.

For the 10th time in a row, the RBI (MPC) Monetary Policy Committee on Thursday left the key level that did not change – repo at 4 percent and the repo on 3.35 percent – and decided to continue with the attitude of the accommodative policy.

Underline the growth is not evenly distributed and needs to be treated again, the watershed said that “monetary and fiscal policy cannot be a good question or, but must coincide with each other, especially at times like what we experience for the past two years Of course.

” For requests whether the central bank has fallen behind the curve of his colleagues, the watershed said, “We are very clear of our attitude and our assessment is very synchronous with our developing domestic situation that is very different from our central banks that have left the money policy Loose.

“Our assessment and policy steps produced are completely directed by domestic inflation and developing growth scenarios”.

Many central banks throughout the world move towards Hawkish monetary policy approach amid increasing prices.

Stability is “the top in our minds”, Das say that at the same time, it pays attention to the need to continue to support growth so that it makes it even more and sustainable.

“That means in our view, we are not behind any curve because our domestic factors are different,” 5, at least with budget speeches .

So, they are on a road map and so are the RBI.

We are located In a well-coordinated action plan on our respective targets.

Definitely the fiscal part has a greater role to play but we also have to understand that the RBI also has a key role to be played in this case, “said the watershed.

Stressing that fiscal and monetary policies must move in perfect coordination, it shows that signal growth Uneven is what has made us project an economic expansion that is lower 7.8 percent of the next fiscal.

Regarding including government bonds in the Global Bond index, DAS said, “Our approach has been very calibrated because the problem has negative and positive things” .

“Although it can get more inflows (projected as high as $ 30 billion per year), it can also cause too much volatility, which will compensate for all the benefits of the inflow.

Because more than 90 percent of government debts are denominations and only 5-6 percent in forex.

That’s why we took a very calibrated approach, “he said We do not like sudden changes and surprises ” “.