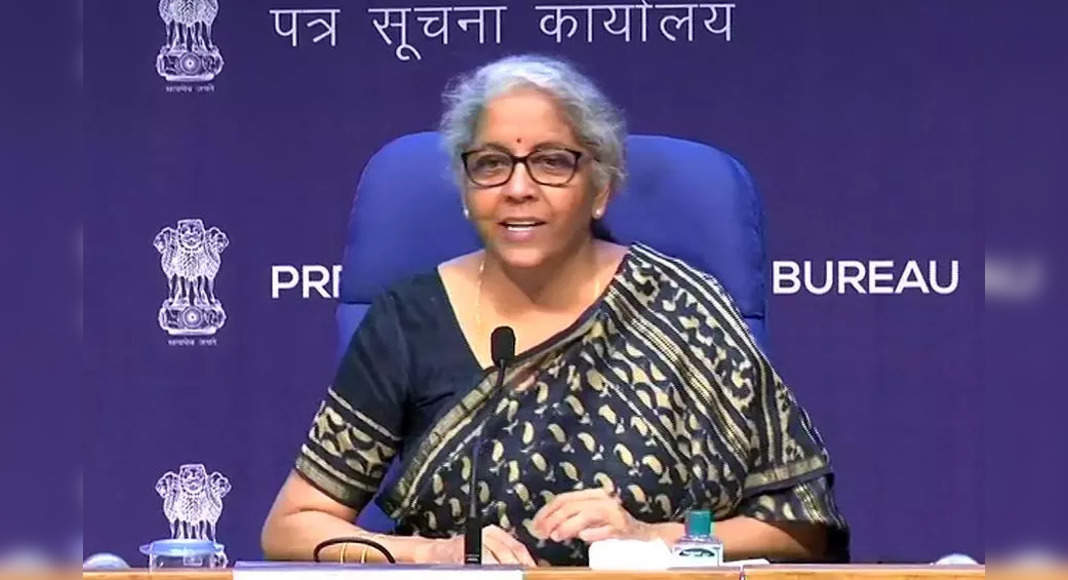

Mumbai: India requires at least four or five banks that match the largest lender, Bank Negara India, to fulfill its economic needs, Finance Minister Nirmala Sitharaman said on Sunday.

The thought of combining banks even before the pandemic increased to meet the new and changing economic requirements, Sitharaman said at the annual meeting of the Indian Bank Association.

“The economy shifts to a different plane at all,” Sitharaman said.

“Even before the driving force pandemic for the merger (bank) is that India requires more banks, but more large banks.” He added, “Now all the reasons we will need four or five SBIS in this country.” He doesn’t provide details.

But the government has consolidated the government-managed banks to combat the slowdown of the pandemic and create larger and stronger banks while it also seems to sell stakes, and privatize, at least two state-run banks.

Last month, the state bank India reported the first-quarter earnings record and bet on economic activities taken to contain a bad loan surge, send bank shares managed by all times.

Sitharaman praised the banks that joined because they have been successfully carried out during pandemics without uncomfortable customers, but said the bank’s internal system must be able to communicate with each other even regularly.

“You can no longer be in a digital silo,” he added.

“All systems you have to talk to each other.” Banks are less burdened today because Cleaner books will cut the government’s burden in their recapitalization, he added.

Domestic banks have struggled to limit bad loans, especially in their retail portfolio, as a pandemic and locking produced achieving economic activity and limited borrowing capabilities to repay.

CO Reconstruction of newly formed national assets and co-debt restructuring will be together can cut non-performing assets (NPA) from the banking system, restructuring and selling it, Sitharaman added.

“This is not a bad bank.

Because it is driven by the bank and because it is encouraged by feeling to clean up quickly, you have given yourself this framework that will help in the disposal quickly (NPA) with responsibility.” He said.

“This is the formulation that you gave you and hence I thought it would work and would work quickly.”