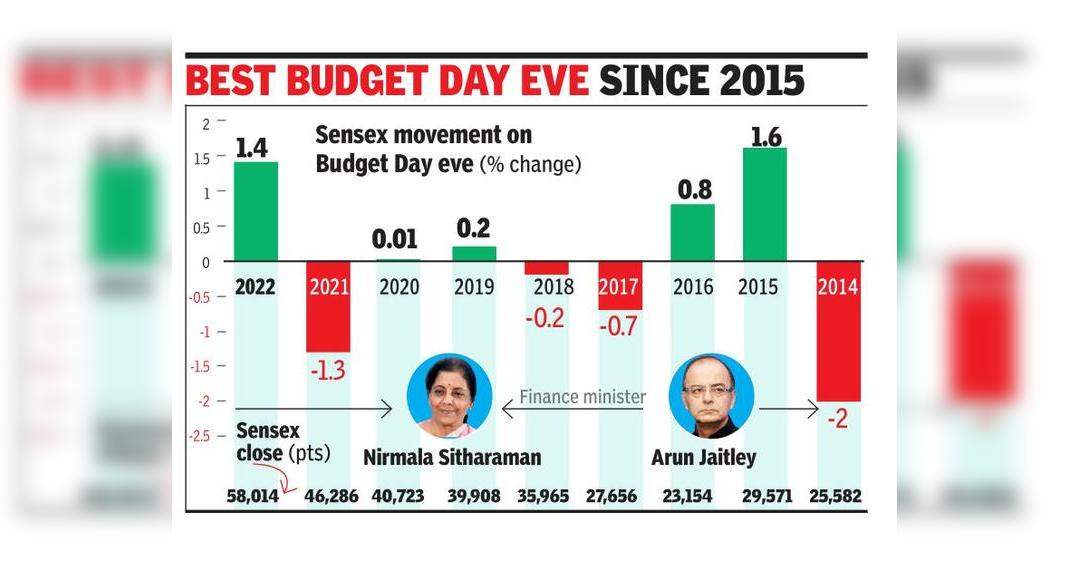

Mumbai: Supported by a rebound in the global market, Sensex strengthened through a session Monday and closed 814 points higher at 58,014 as a strong growth projection in economic surveys increasing investor sentiment.

Buying was across the board, with 27 of the 30 sensex constituents closed higher, which took it reversing a decline of two sessions.

However, a 1.4% increase from Sensex came despite the clean sales of Rs 3,624 crore by foreign funds.

Domestic funds are clean buyers at Rs 3,649 Crore, BSE data shows.

According to the Shrikant Chouhan Securities Head (Equity Research) box, because the market is in the Oversold position, a sharp shout Monday is on the path expected in front of the budget.

“The upward bias is also supported by strong global cues and economic survey reports that have pegged strong GDP growth for FY23,” Chouhan wrote in post-market records.

Rally that day, led by strong purchases in Infosys, Reliance Industries and HDFC Bank, added around RS 3.3 lakh crore to the wealth of investors.

BSE Market Capitalization is now on the Crore Rs 267.4 Lakh.

On the Forex market, it was assisted by a strong dollar flow from the company, Rupee closed 42 Paise stronger at 74.62 to one dollar.

In the government bond market, after RBI announced that short-term government bonds worth around RS 1.2 Lakh Crore will switch to longer dating bonds, enhanced sentiment and 10-year gilt benchmarks closed at 6.68%, softer than 6.75% Friday.

Even though there was an increase in days in Rupees, market players maintain their attitude guarded because of strong foreign funds.

Data donated from CDSL and BSE showed that during January, foreign portfolio investors (FPI) clean stock worth RS 36,928 Crore, the highest monthly outflow since March 2020.

If FPI Outflow continues to February as the US Federal Reserve prepares an interest rate increase.

In March, Rupees could face weaknesses, they said.

In the bond market, investors will oversee the budget, especially the loan program for Fiscal 2023 because it will have a major implication on the trajectory of the results from here, said bond market players.