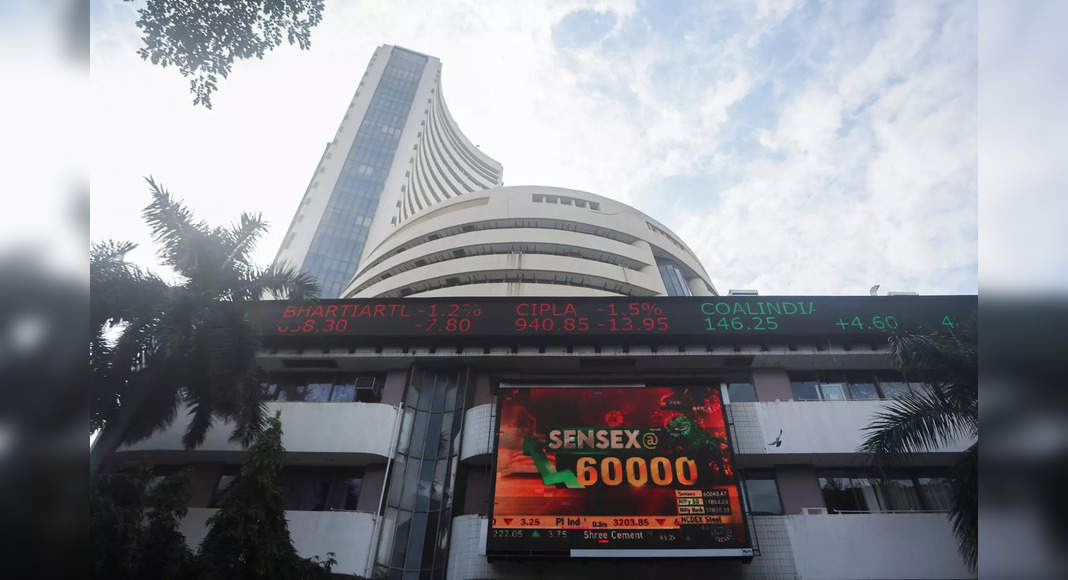

Mumbai: The initial rally in Dalal Street on Tuesday took Sensex past the 62K sign for the first time.

But taking profits by a large number of investors behind the surge in stock prices has led to strong sales in the leading index outside.

As a result, after the highest life at 62,245 points in the middle, the market witnessed strong sales in the final trade and closed at 61,716 – down 50 points that day.

Sensex only takes two days to pass the 62K mark from 61K, one of the fastest to cover the gap 1,000 points.

It took nine months to rally from a historic 50K mark on January 21 this year to 62k on Tuesday.

According to the Head of Financial Services Oswal Motilal (Retail Research) Siddhartha Khemka, the domestic market opened above 62K and continued its positive rally supported by its global colleagues, but witnessed great volatility to finally close the session.

“The festive atmosphere along with further relaxation (from covid related limits) in Maharashtra continues to comfort investors and thus encourage positive momentum.

Accelerated demand and good quarterly companies have made investors’ interest being optimistic,” Khemka wrote in post-records market.

“However, the increase in global commodities and energy prices continued to cause worries.

With many heavy-classes that reported their number this week, it would make the market remain turbulent.” Slide the days outside Sensex clearly from selling in several sectors that have outperformed the index.

At the end of the session, the Realty BSE index closed 4.6% lower while FMCG lost 3.1% and consumers accommodate an index of 2.9%.

Among a handful of sectoral enhancers (up 1.3%) and capital goods (up 0.6%).

Today’s selling-off also made more poor investors by Rs 3.3 Lakh Crore with BSE market capitalization now at Rs 274 Lakh Crore.

Data at the end of the day in BSE also shows that foreign and domestic funds are clean sellers of each RS 506 Crore and Rs 2,578 Crore.

From the end, foreign fund managers have taken money from the Indian stock market with the numbers of inflow net October now around Rs 1,200 Crore, compared to the net entry stream of Rs 13,154 Crore in September.

Among 30 sensex shares, 16 closed in red, while 14 closed higher.

However, in a broader market, a very tilted face drop ratio supports a reduction in 935-to-2,427, BSE data shows.