Mumbai: With governance in sharp focus in India Inc., the Corporate Council and Puncak Management may feel harder to encourage their agenda if they are not aligned with a broader interest of all shareholders.

Investors empowered increasingly voiced concerns about a series of controversial problems, ranging from compensation, appointments and related party transactions, ending the era when the GMS was only regarded as a checkbox item, and most of the resolution sailed.

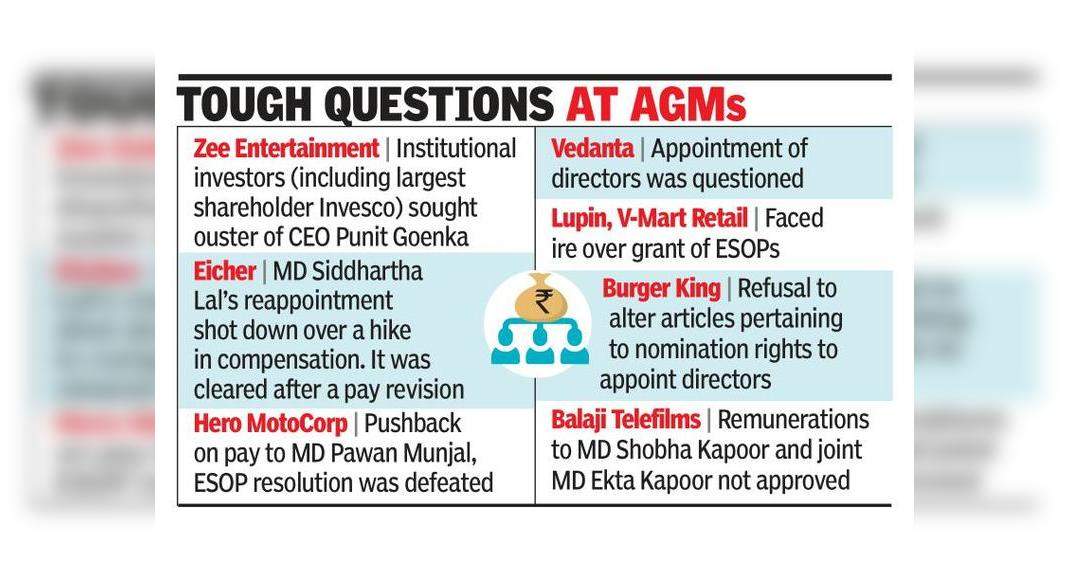

Recently, Zee Entertainment has become the main headline due to an intense boardroom upheaval with institutional investors looking for Ouster CEO of the Company & MD Punit Goenka.

In August, the removal of Eicher MD Siddhartha Lal was shot in increasing compensation at the GMS.

It was cleared by the company’s board after revising the payment at 1.5%, such as opposing a higher limit at 3% of the profit, which is the approval of shareholders will be taken.

While in July, there was a shareholder pushback on the remuneration of the MOCOrp Hero MD Pawan Munjal, with an ESOP resolution (employee stock option plan) was defeated.

However, the previous proposal was approved.

Likewise, companies in all sectors, including Vedanta and Lupine, are faced by shareholders for the appointment of directors, and the provision of ESOPs, respectively.

Also, in August, the ESOP resolution at Retail V-Mart was defeated, and as well as changes to the Burger King’s budget, related to the promoter nomination rights to appoint directors on the council.

Balaji Telefilms Resolution for the approval of the remuneration of MD Shobha Kapoor and Joint MD ETTA Kapoor also failed to pass through riots at the GMS in September.

Usually, resolution does not get green light in 20-25 companies from BSE 500 every year.

That number rose this year with a number of leading names, the word industry observer.

KPMG India Partner Sai Venkateshwaran said, “UPTREND is due to a combination of factors, whether it is more active institutional investors, empowered with better information to ask difficult questions, or current economic environments and related uncertainty.

Institutional investors, including mutual funds , Pension funds and insurance companies have also become more vocal in voicing problems, and the mandate of regulations regarding the implementation of the stewardship code by Sebi, PFRDA and IRDA seems to have a positive impact.

“Under the code, they are required to have clear policies about voting and revealing Voting activities, in addition to their role in involving, and monitoring their investee company.

This code also requires them to be willing to act collectively or collaborate with other investors if necessary, which will also produce collective actions by investor groups, whenever they are needed.

Institutional investors also have access to the selection recommendations studied released by the proxy advisory firm, which allows them to receive further calls, experts say.

“The resolution that we have seen was shot down by investors for the past two years in various categories – compensation, appointments, related party transactions, changes in the article article.

This is an indication that investors are looking at companies in a holistic way and do not focus only on one aspect Business.

This year what has changed is that many famous companies come under investor lenses, ” said Amit Tandon, Founder and MD in IIAS, a proxy advisory company.

Furthermore, from the shareholders’ point of view, there is hope that compensation for KMP (Main Managerial Personnel) and promoter, it must be synchronized with the performance of the company.

While there has been an increasing demand for linking variable salaries with company performance, these calls are emphasized in the economic environment that shows a slow degragat or growth in the company.

“Increasingly, it is clear that the promoter might no longer feel easy to get Kan resolution is passed on the AGMS, etc., especially when the sound of minority shareholders is more relevant.

Even in the case when the resolution was approved, but most institutions have chosen to oppose it, he sends a signal to the market on investor sentiment, and is a soft indicator to sit back and rethink some of these decisions, “Venkateshwaran.

Added.

With ESG problems (environment, social and governance) taking a central stage in a global company, governance will be the main framework for focusing on India Inc.

to manage both performance and goodwill.