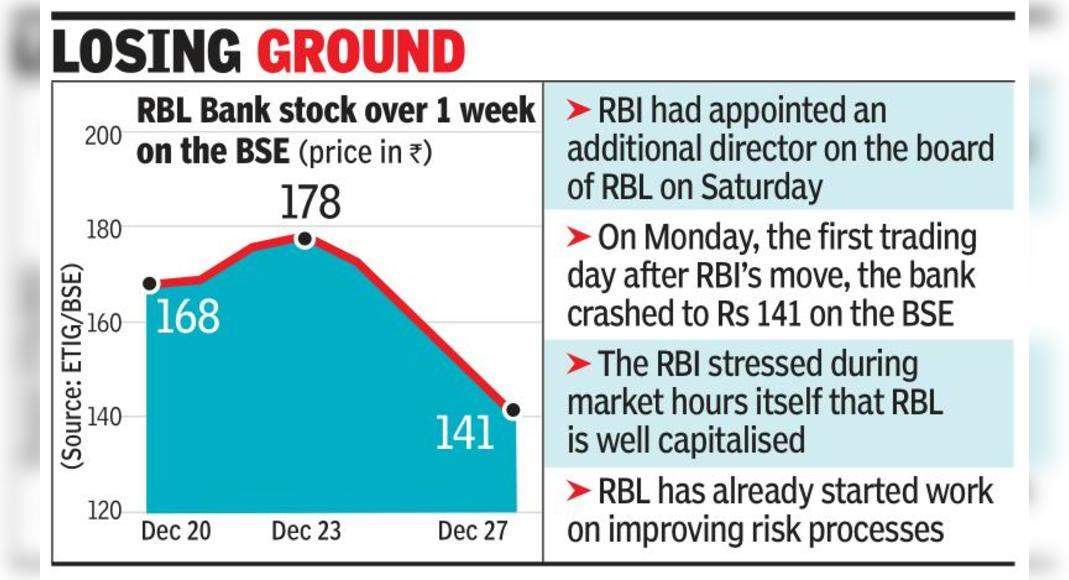

Mumbai: Bank RBL shares closed 18% on Monday after the Reserve Bank of India (RBI) appointed an additional director on the Bank Board.

RBI’s move to follow the CEO of RBL Bank Vishwavir Ahuja will depart medical six months before his tenure ends.

RBL was opened weakly at Rs 155 on Monday after weekend development and reached a 20% lemoner of RS 132, before recovering a little and ended at Rs 141 – 18% lower than the closing Friday RS 173.

This pushed the RBI to issue a statement Looking for quell speculation about banks.

“Banks with good capital and the Bank’s financial position remained satisfactory.

According to the results of the annual audit audited on September 30, 2021, the Bank has maintained a convenient capital adequacy ratio of 16.3% and the ratio of the coverage of the provision of 76.6%.

Liquidity Coverage Ratio ( LCR) The bank is 153% on December 24, 2021, as a 100% regulation requirement, “RBI said in his statement.

In the afternoon release, RBL Bank said it has extended its five-year partnership with Bajaj Finance for co-branded credit cards.

This is likely to be seen as a measure of trust as happened after the RBI comes with the director.

Overcoming Media On Sunday, Interim CEO of Bank Rajeev Ahuja, who until now a executive director, said that the RBI nomination in the Board would help the Bank in improving the process of risk management and compliance.

He also said that the term one year Vishwavir Ahuja means that a successor must ultimately be identified and his cutting has triggered the need.

According to sources, the RBI nomination on the board, Yogesh Dayal, will help the bank in the successor identifying process.

The bank has begun work on improving the risk process.

Last year, the bank brought Deepak Kumar, who was previously the main general manager with SBI and has served on the RBI committee for the PMC Bank crisis settlement.

“Feedlifting that the appointment of additional directors in private banks was carried out based on section 36AB from the Banking Regulation Act, 1949 as and when felt that the Board needed closer support in the issue of regulatory / supervision.

Thus, no need for depositors and other stakeholders to react Against speculative reports.

Bank financial health remains stable, “RBI added.

The part quoted allows the RBI to appoint directors for the interests of banking policies or in the public interest or for the benefit of banking companies or deposits.

The previous RBI appointed an additional director at the Yes Bank Bank, Jammu & Kashmir Bank, Ujivan Small Finance Bank and Dhanlaxmi Bank.

Motilal Oswal in a report, “The current development has raised concerns about the bank’s ability to maintain rotation in its operating performance, while at the same time raising concerns about similar actions by regulators in other medium banks, where operating performance has been sub-optimal.

With Thus we place our ranking in reviewing and keeping further progress and waiting for further clarity in the results of 3QFY22.

“