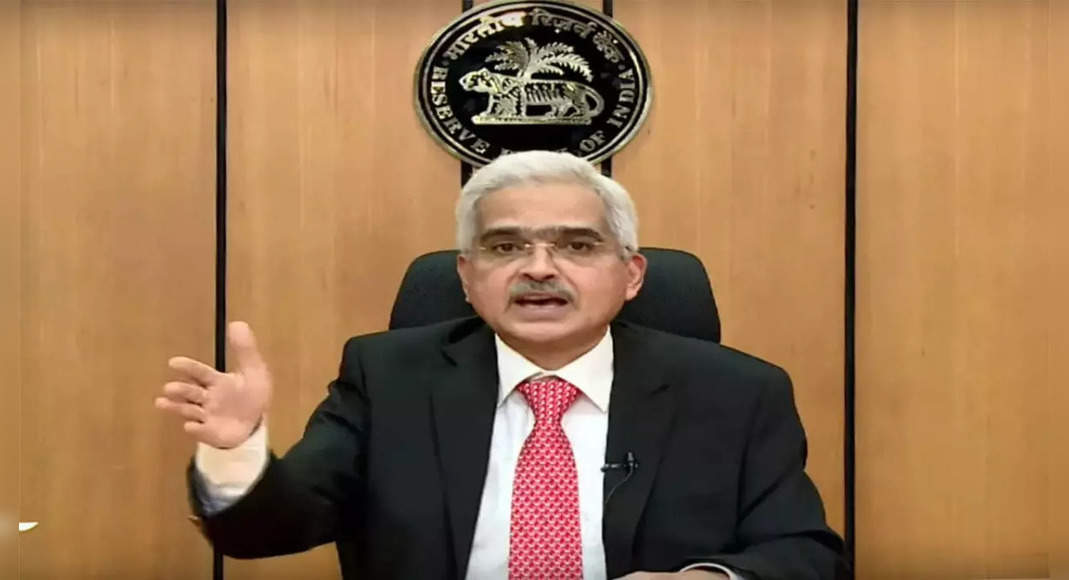

Mumbai: The Governor of the Bank of India (RBI) Shaktikanta Das on Thursday which surprised the market with Super Dovish monetary policy which not only left interest rates unchanged but also maintained an accommodating attitude.

Post-Policy comments also support growth with the governor who said that the next year’s loan program would not be a burden that looked like that.

The status quo means that the cost of home loans and other loans that are linked to the repo level will not rise for now.

Deposits may also not rise sharply.

With the repo and the Reverse Repo Rate was maintained at 4% and 3.35% for the 10th consecutive policy, the focus shifted to reform in the financial market.

The repo is a level where the RBI lends to the bank, while the repo is reversed where it borrows from them.

In post-policy interactions, the governor shows that next year’s loan program will not be as big as projected in the budget and say that the RBI has given a stranger’s head space to invest Rs 1 lakh crore in Indian bonds, which will eat some large loan pressures.

RBI also lifes the rules of the derivative interest rate, providing more headrooms to expand hedging products to borrowers.

“The government will borrow Rs 65,000 Crore to be forwarded to the National Highway Authority.

This money will be raised by Nhai,” said the watershed.

He added that the government also indicated that collections in small savings would be higher than expected, resulting in lower needs to borrow.

Many expect the central bank to climb the reverse repo level to reduce surplus funds.

RBI officials also showed that the central bank did not take a position that was not contributed, but the situation in the field was different.

“All inflation characters in the US are different.

In the US, used car inflation is the main component, we don’t have it and we also don’t import used cars.

In Europe, one of the problems is the availability of truck drivers, we don’t have that problem in India.

Food inflation According to food and agricultural organizations ruled at 29-30%, but our food inflation was 6.5%, “said Deputy Governor of RBI Michael Patra.