WASHINGTON: Biden government takes steps to overcome economic risks from climate change, publishing a report of 40 pages on Friday on government plans widely to protect the financial markets, insurance and housing and saving American family.

Under the report, the mortgage process, stock market disclosure, retirement plans, federal procurement and government budgeting are all reconsidered so that the state can provide prices at the risk of climate change.

This report is a follow-up of the May executive command by President Joe Biden who basically calls the government to analyze how extreme heat, floods, storms, forest fires and wider adjustments to overcome the world’s largest economy.

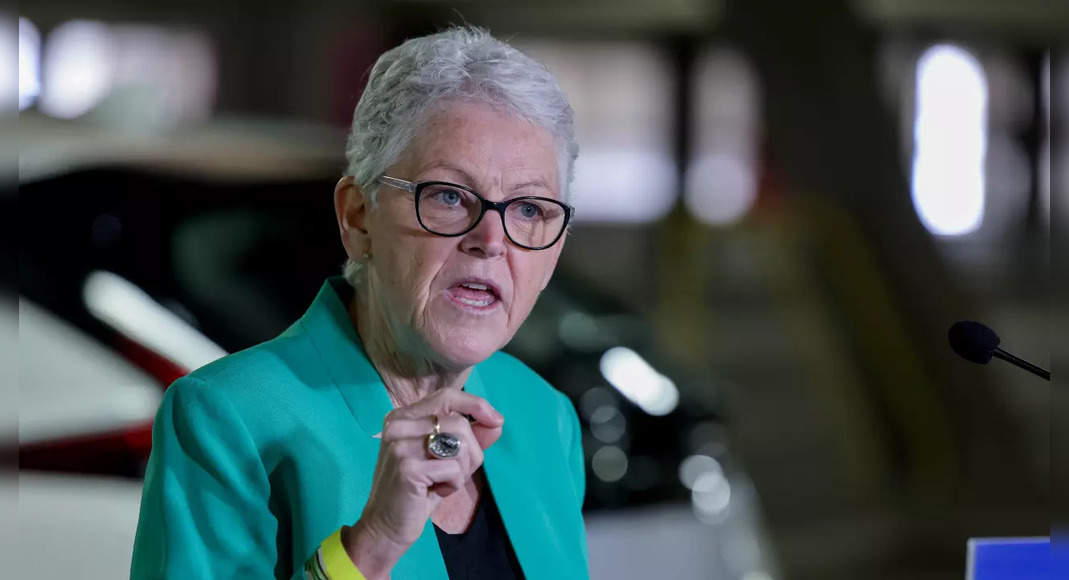

“If this year shows us anything, it is that climate change has a sustainable urgent and systemic risk for our economy and for the lives and livelihoods of everyday Americans, and we must act now,” Gina McCarthy, climate advisor The White House National, told reporters.

February hurricane in Texas caused a widespread electricity outage, 210 deaths and damage to severe property.

Forest fires raged in Western countries.

The hot dome in the Pacific Northwest causes recording temperatures in Seattle and Portland, Oregon.

Ida storm hit Louisiana in August and caused deadly floods in the northeast.

The action recommended by Biden administration reflects significant changes in broader discussions about climate change, indicating that the nation must prepare costs that the family, investors and the government will bear.

This report is also an effort to show the world how serious the US government is overcoming climate change ahead of the UN Climate Change Conference from October 31 to November 12 at Glasgow, Scotland.

Among the steps described are the Government’s Financial Stability Supervision Board develops a tool to identify and reduce the risk of climate related to the economy.

The Treasury Department plans to address the risk of the insurance sector and coverage availability.

Commission Securities and Exchange are looking at mandatory disclosure rules about the opportunities and risks produced by climate change.

The Labor Department on Wednesday proposes rules for investment managers to factorize environmental decisions into choices made for retirement and retirement savings.

The management office and budget announced the government will begin the process of asking for federal agents to consider greenhouse gas emissions from companies that provide inventory.

Biden budget proposal for Fiscal 2023 will display climate risk assessment.

Federal institutions involved in loans and mortgages for homes seek impact on the housing market, with housing departments and urban development and their partners develop disclosure for home buyers and risks related to flooding and climate.

The business veteran department will also see climate risk for its home loan program.

The Federal Emergency Management Agency renewed the standard for its national flood insurance program, potentially revised the guideline that returned to 1976.

“We now realize that climate change is a systemic risk,” McCarthy said.

“We must look fundamentally by the way the federal government does its job and how we see the financial system and stability.”