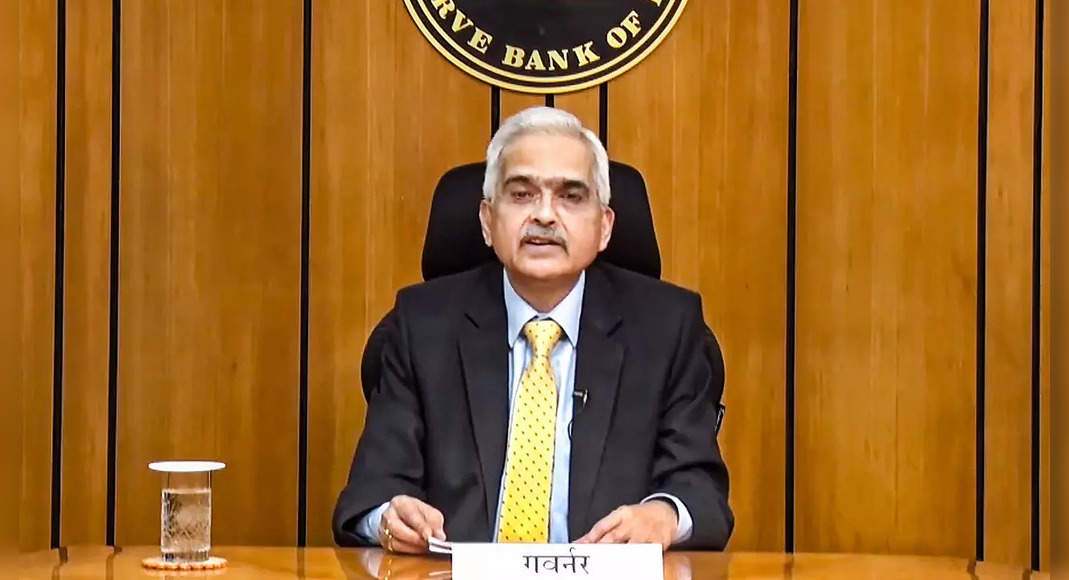

New Delhi: A week after the 2022-23 budget proposes a 30 percent tax on profits made from Cryptocurrency trade, the reserve of the Governor of Bank of India (RBI) Shaktikanta Das call it “threat to macro and financial economic stability”.

Announcing the results of bi-monthly monetary policy, the watershed the investor by asking for the 17th century ‘Tulip Mania’ – which is widely regarded as the first financial bubble.

The Governor of RBI said that investors must remember that Cryptocurrency did not have a basis, not even tulips.

Read Alsorbi make repo rates unchanged at 4%; Maintaining the accommodating Stancethe Reserve Bank of India (RBI) Monetary Committee (MPC) on Wednesday unanimously decided to keep the repo not change at 4 percent for the ten consecutive time and continued with an accommodating attitude.

Repo Rate is a level in which the RBI lends to the bank, while reversing repo rates is the central bank always maintains a strong attitude towards personal digital currency.

It has forested the banking system from helping trade like that, which was shocked by the Supreme Court in 2020.

The watershed said it was “task” to warn investors, and told them to remember that they invested their own risk.

What is’ Tulip Mania’the ‘Tulip Mania’ 17th century is often quoted as a classic example of a financial bubble where the price of something rises, not because of its intrinsic value but because of the speculators who want to get profit to sell exotic flower bulbs.

It is also known as the Dutch tulip market bubble and took place in the Netherlands in the early 1600s.

It is one of the most famous market bubbles and crashes all the time.

Also read: Why RBI does not raise interest rates for the 10th consecutive time and what it means for you has decided to keep the policy repo policy unchanged at 4 percent and to continue with an accommodating attitude as long as it is necessary to revive and maintain growth on the basis of Which is durable and continues to reduce the impact of Covid-19 on the economy, while ensuring that inflation remains in the recording of tulip bulbs and they are traded at a higher price.

In today’s context, it functions as a parable for traps that excessive speculation can lead to.

Cryptocurrency is said to originate or ‘mined’ using a complex algorithm built on the blockchain platform but critics say it does not have a ‘value’ of the legal tenders whose supplies are regulated.

After being mined by running the program, the Cryptocurrency unit is traded on the secondary market where the value is very fluctuating.

Therefore, the Governor of RBI uses this parable to warn investors.

‘Carefully developing to introduce the digital currency’ Shaktikanta Das said that the central bank did not want to rush and carefully examined all aspects before the introduction of the central bank’s digital currency (CBDC).

Read a lot of progress to introduce digital currencies; Do not want to be in a hurry: RBI Governordays after the government said the reserve bank would introduce a digital currency in 2022-23, the Governor of Shaktikanta Das on Thursday said the central bank did not want to rush and carefully examined all aspects before it was introduced, however, Digital Bank Central Bank (CBDC).

He, however, refused to give any timeline to the launch of the CBDC.

“This (CBDC) is one thing where we don’t want to rush.

We carefully and carefully check and come forward because there are many risks.

The biggest risk is related to cyber security and the possibility of forgery,” said the deepest watershed A post, “DAS) -Policy Presser.

In his budget, 2022-23 Speech, Minister of Finance Nirmala Sitharaman has announced that the RBI will introduce the digital currency in the next financial year starting April 2022 to improve the digital economy and for more efficient currency management .

(With input from the agency)