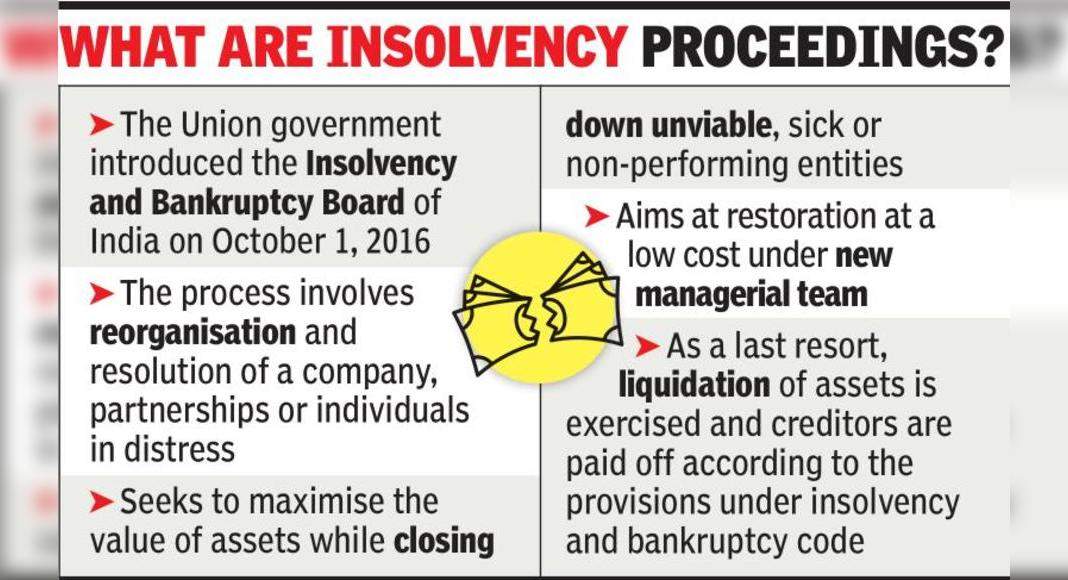

Greater Noida: This is not only a stalled housing project, both industrial authorities in Noida and Greater Noida wrestle with other issues – complex bankruptcy settlement processes.

While the Noida Greater (Gnida) authority deals with 21 cases of bankruptcy processes before the National Law of Court Law and National Law Appellate Tribunal, Noida Authority is a party for 16 cases of the resolution, nowadays.

The results of this process have a significant influence on their financial health, which is a source of anxiety for the development authority struggling to restore contributions from developers who experience thousands of crores.

In August 2017 that the two authorities had their first brush with bankruptcy code when the bench of Allahabad from NCLT announced the initiation of the bankruptcy process against Jaypee Infratech.

But for the past four years, legal cells from the authorities have failed to build strong cases before the court and lose a lot of attraction.

The latest appeal, on November 10, met the same fate at NClat.

In this case, related to Apex Alphabet (formerly Misty Heights) in Techzone 4, Gnida has appealed the NCLT sequence and submitted its claim as a financial creditor before professional resolution in February 2020.

A operational creditor has initiated bankruptcy process on Maple Realcon Private Limited, Promoter Apex, in July 2018.

NClat rejected Greater Noida’s appeal against the NCLT Order, saying that it was too late to submit claims as a financial creditor even though it was aware of the bankruptcy process on the company.

Senior lawyers say bankruptcy and bankruptcy code are laws that need expertise to deal with.

“Understanding all the nuances associated with bankruptcy code requires many studies.

Plus, some amendments have been made for years to meet the growing needs.

Understanding jurisprudence of financial debt and the value of money time requires a lot of homework.

Authorities require an independent view and handreholding By industry experts to deal with this problem because it is a new subject for all of us, “Aditya Parolia said from legal PSP.

He clarified that the bankruptcy code and bankruptcy was not a framework designed to restore contributions from the company.

On April 16 this year, Noida authorities appealed the Shubhkamna Buildtech Pvt Ltd resolution process, a group that had floated in the project in sector 137.

The appeals court rejected his request considered as a financial creditor and refused to entertain the argument.

The rental act with the Shubhkamna group must be treated as a financial document, observing these papers cannot be categorized in Indian accounting standards.

Since then, Noida has lost the battle in cases of bankruptcy completion to be classified as financial creditors than operational creditors.

Financial creditors have more rights in the overall process and have the authority to vote at the creditor committee meeting.

While Noida authorities are in the process of choosing an expert agent who can guide officials about the bankruptcy process, Gnida hasn’t taken such a step.

Narendra Bhoooshan, CEO of Gnida, said that detailed detailed documents had floated.

“We have mentioned all our requirements in the proposal and has invited an offer from legal experts.

We have identified four fields where we need to focus and will choose the appropriate legal consultant,” he added.